Creative Genius Podcast

Avoiding Pitfalls When Selling Your Business (Manny Clark)

As with any major transaction, many things can go wrong when selling a business. You need to be well-informed and diligent from the very beginning. Some mistakes or oversights could end up reducing the value of your firm or saddling you with a high tax liability. Working with qualified professionals from the start can help ensure you get the most value and other conditions you want from your sale.

In this episode, Gail invites attorney Manny Clark to the podcast to discuss what factors owners need to consider and plan for when deciding on their exit strategy from their business. Manny is a corporate and mergers and acquisitions (M&A) lawyer and shareholder in the firm Winstead, P.C. His practice is based in Charlotte, North Carolina.

Manny stressed the importance of developing an exit strategy as early on in the creation of the business as possible. He also recommended that when it comes time to execute that exit strategy owners engage the counsel of qualified professionals at the start. Doing so can help prevent costly mistakes or delays and ensure that the seller gets the best deal possible.

Gail asked Manny what owners should ask when seeking a professional to work with. First, he said, ask them about their ability to handle your transaction.

- Do they have experience in your industry?

- How many sales or mergers of your kind have they performed before and what was the outcome?

- Ask them to explain what issues are involved in the transaction.

- If you are working with a firm, find out who is going to be leading the transaction and doing the actual work; a senior member or a junior member?

- How much experience does that person have with your kind of transaction?

- What fees can you expect and when will they be due?

Manny then walked through the three major stages of executing the exit strategy. “The single most important thing you have to do is consider that you have to exit your business,” he said. Be clear in your mind what you want your exit to look like and who should be involved in it. That includes putting together a team of qualified professionals to help you with various aspects of the process, such as an M&A lawyer or broker, investment advisor, CPA, and evaluator.

The other stages involve setting your house in order, especially your financials, and organizing your business. “You ultimately have to understand how your business grows,” Manny said, and what are the prospects for future growth for the buyer.

Manny also listed some of the biggest mistakes sellers make in exiting their businesses as well as some of the challenges of trying to sell a small business. For many more details, listen to the entire podcast.

If you’re listening on your favorite podcast platform, view the full shownotes here: https://thepearlcollective.com/s10e7-shownotes

Mentioned in This Podcast

For more information about Manny and to contact him directly, go to his page on the Winstead, P.C. website.

Episode Transcript

Note: Transcript is created automatically and may contain errors.

Click to show transcript

Hi, Manny, thank you for joining us today on the Creative Genius podcast. You and I chatted a few months ago and I thought it would be of great value to our listeners to think about their exit strategy. We’ve had a few other people on our podcast to talk about their experiences as sellers of businesses and we’ve had people that have been on that are actually brokers for businesses. So now we’re going to talk to you from the aspect of you being an attorney.

So welcome to the podcast. Awesome. I’m so glad to be here. really appreciate the opportunity, Gail, and so excited to talk to you and to speak to you, the creative, genius listeners. All right. Well, thank you so much. Well, let’s talk about your role and how you’re involved with business owners in the process of exiting their businesses.

Absolutely. So, you know, from my perspective, and I’m an &A attorney, very often I’m counseling both buyers and sellers in connection with their &A transactions. And quite a lot of my practice involves counseling sellers as they are preparing for and ultimately implementing their exits from their business. And there are all kinds of different exits. And I’ll talk a little bit more about, you know, what different kinds there

today. But within that role, I’d say I really do three things. know, one, I am primarily there to consult with the seller about what are their objectives with respect to their exit and also to help them understand what is possible in connection with their exit. And I can give a bit of an example for that. So you may have some sellers who are interested in ultimately retiring. They see their exit as a plan

you know, obtain kind of final exit liquidity, you know, infuse their retirement nest egg to prepare for, you know, going off into the sunset. And for those kinds of sellers, counseling them in connection with their transaction may mean helping them enumerate legally, you know, a successor to the business. So that may be in the course of, you know, sale negotiating alongside a buyer for

employment contract to keep the employees associated with the business. It may also involve ensuring that non -compete terms, indemnification terms, which are basically the ways in which a seller covers a buyer for problems with the business that occur, that arise or result from some of the pre -closing activities of the buyer, that those things are appropriate for someone who is ultimately

be leaving the business. So that’s one thing I do it. I try and ensure that your objectives are met in connection with the sale transaction. Secondly, it is advising you with respect to what exactly it is within your buyer’s offer. So as sellers, we obviously as lawyers understand you may not be intimately involved with all of the dynamics of emerging and &A transactions.

However, it’s important to note that it is very much a transaction that sits squarely within the realm of corporate finance. The professionals who are frequently involved in creating their entire lives as finance professionals. is very often corporate development professionals, chief executives, CFOs, who often leading this process within strategic buyers that is companies.

Folks from private equity or very frequently folks who have been analysts and investment bankers at very large investment banks throughout the country. And so the folks you were dealing with are used to certain kinds of transactions or willing to give and are willing to enter into certain types of trades when it comes to a merger and acquisition transaction. And so my job is to help you understand what terms attend those trades,

you can get and what may be unrealistic as a part of that. And then finally, it’s to negotiate on your behalf and ultimately seek a closing on behalf of sellers. So that is, I will try for my position as an &A attorney and with my knowledge to seek the best deal for you, to try and implement whatever exit strategy you would like to implement and that’s possible alongside a buyer and ultimately do all the things that

help you get to a closing, including we need to refer in different individuals, either from my firm or from outside firms to assist. And that’s lawyers, accountants, investment bankers. It is helping you sign things. We’ve done pretty much everything. is core your services at midnight to get signatures if necessary. So that really is my role within the &A process. OK, so you’re babysitting the whole process, in other words. Exactly.

That is that’s precisely it. And we enjoy that. And I enjoy that my pride is this is difficult. And you know, I know it is a trade. It’s a financial trade. And so it is something where someone who is not accustomed to this kind of trade does need a little bit of hand holding. And that’s fine. Everyone needs experts to, you know, to refer to. And in this case, we get to be that for our clients.

Well, it’s very complicated. just finished a podcast with someone else who just sold her business last week, closed on it and is done. And ironically, as an interior designer, she actually has, she was an investment banker first. And so she came into this with a lot of knowledge, but it was so interesting having the conversation and understanding from her perspective that even with that knowledge, she didn’t know all the things that she was going to encounter.

And her comment was that the transaction attorney was the most important part of her whole process of having somebody who really understood the ins and outs of the agreements and how to negotiate those and what the contracts meant. And I just thought I would share that with you because we literally just finished that podcast about an hour ago.

So it is it’s wonderful to hear that. I’m sure that there are clients who, you know, view who share her feelings. You know, from my position, I certainly think it’s the case. We we hold a really interesting position in the set of advisors in the sense that we are, you know, an advisor who, you know, due to our ethical obligations are required to represent you zealously to look towards your interests in either the seller or the company’s

before our own and additionally, even where it may implicate potential conflicts. And we have to get rid of those conflicts from our perspective. in our view, we need to be intimately into what it is you want out of your transaction and fighting for that at all times. So I’m glad that she got that in Connection Threat Transaction. She She ended up with a very successful sale.

She’s very organized and very thorough and luckily has super clean books. So she knew what a lot of what she needed to do to go and prepare for this. Thank goodness. She made it easy on everyone and herself. Well, it wasn’t easy according to her. So that’ll be interesting for everybody to hear that conversation with Kirsten Kaplan. It’s her name. So how soon should you as the transaction attorney be involved in the process of the sale of the business and why so soon?

Sure. I will note, I think there are differing opinions about when to involve a transaction attorney. I would say, I think the preference, this may be the preference among lawyers, but I would say it also, there are quite a lot of number of benefits to it, which is, I think it is important for clients at the start of their entrepreneurial journey to try and establish a relationship, even if it is a small one, with a competent business law

That business law firm can do small things for you. Hopefully that you do not find to be quite taxing when it comes to fees. But having that relationship allows that firm to give you counsel from the beginning. That counsel helps to ensure that what you’re preparing when it comes to your own organizational elements, end up being at the end of the deal or during the deal, one of the most important things that you can do, you make representations to it that often

you know, become what are called fundamental representations in that, you know, a buyer will want coverage for it almost forever in some instances. Having a law firm back you at that stage creates a lot of institutional knowledge for that law firm, such that in connection with the sale transaction, they know where everything is. They know where the contracts are. They need to have written the contracts. In many instances, they may have prepared your organizational documents and can assure you

Pearl Collective (09:48.526)

what you have is something that a buyer would appreciate. I think there’s that benefit, certainly for sellers, and it just, makes it easy for these deals to close. However, I know a lot of sellers probably will not take that route and that’s fine. I would say, barring that, a great place to start with a transactional attorney is probably at the start of the year or 12 months before you believe you’re gonna enter your sale transaction. That’s likely.

around the exact same time that you may have also hired an investment advisor with respect to your transaction. The benefit there is that that is the place where your investment advisor and your lawyer can work together really collaboratively. If you are say, you’ve hired an investment advisor and then investment advisor has determined, look, we think your best price could ultimately be obtained by going to auction, which

your advisor is going to make a blind item, send it out to a number of buyers. You you’ll ultimately produce an information memorandum that will also go to buyers. And eventually you will whittle down to a set number of potential buyers in your transaction. At some point, your buyer may say, look, we want to get anyone out who we don’t think is going to help us get to the best deal. They’re tapping your lawyer to say, I want you to draft a bid.

you know, purchase agreement, which is effectively your version of what a perfect, perfect document will look like. that puts you in a really good position. And that’s something that often can occur six, five, six months out from an actual sale. This is where buyers are taking a look at it and saying, you know, Hey, I think I can live with this. I don’t think I can live with this. but at that point that you have secured that lawyer so far ahead.

They’ve had the opportunity to really dig into your books, get a sense of where the holes, how can we fix them? They may have prepared purchase agreements for you. They may have otherwise done things to help you get ready for your sale transaction. And ultimately they’re helping you negotiate your LOI. LOI, that stuff right there. I apologize for that too. A letter of intent. that

Pearl Collective (12:08.738)

That’s generally the document that you will execute with the buyer that puts you under exclusivity, which is your agreement with the buyer that you will not go out and try and sell your company to someone else. that, you know, having being in that position as an attorney to advise you with respect to all of those aspects, including your LOI, we get to help shake the deal for you. Often I find that when clients select us after the

we’re inheriting a deal that takes the shape that the buyer wanted it to take. And sometimes that doesn’t have the best consequences from a tax perspective or legal perspective from your indemnification. We want to put you in the best position possible. And that’s why I suggest earlier is a little better here. And you also mentioned another &A, which define that because some people don’t know what that means.

Yeah, &A is mergers and acquisitions generally. I use that to refer to all kinds of different transactions that a seller would ultimately enter into that involves a transfer with respect to the business. And that transfer could be I’m selling equity in my business, which is stock or my membership interest in my LLC. I’m selling the assets of my business. So someone, a buyer out there may say,

Well, gee, I don’t want to buy everything in the business, but you may have some really great ideas or a great IP related to something out in the world that they can generate cash flow. And they may just buy that. That’s still an &A transaction. And so it is any sale involving a major portion of your business or all of your business. OK, very good.

The other thing that I think is important here is in finding the right professional to work with you in your transaction, what are some of the questions someone should be asking to make sure they’ve got the right person on board? Absolutely. And I’ll note with respect to these questions, I think the key thing to look for when you’re talking to a lawyer is you want specificity about their ability to handle your matter.

Pearl Collective (14:29.848)

how they would handle it and what they think is important that you should also find important in your manner. So I think the first question is really, have you done deals of a similar size involving similar businesses that you can talk to me about? And what you would wanna hear from your lawyer is yes. And they may be able to tell you, I’ve done these deals, if you’re looking at or you believe your valuation is somewhere around

you know, $10 million, you know, $10 million in total, you may say, hey, I want to hear that you’ve done $10 million deals pretty often that you may do them pretty frequently and for similar businesses. The reason for that is that there are different issues that attend different businesses. You know, a sale of a manufacturing company that, you know, manufactures some product that may be highly explosive, for

The issues that attend that are very different from the issues that attend the sale of an interior design business. And you want an attorney who knows how to deal with those issues, knows how to also assuage the feelings of a buyer who may say, hey, I don’t feel comfortable with the particular issue that has come up. What comfort can you grant about it? So I think that’s the key. And you want to hear specificity about someone having done similar deals.

The second thing that I want to get a sense from is what does the person think are the principal issues associated with your transaction? Some of this is going to be dependent upon what kind of trade, what kind of transaction you’re ultimately interested in. If you’re being bought out by another company, similar to yours, that may be a competitor, the issues that attend that transaction may be very different from the ones that attend a

that is led by a private equity sponsor. So in that case, want your buyer to be able to, not your buyer, but your attorney to be able to suggest to you, here’s some of the issues you should be aware of in connection with a strategic transaction in this industry. For a strategic, in many cases, they’re gonna say, well, we may not actually want you as a part of the business. We may wanna close it. And that may, or your exit strategy may not be something you

Pearl Collective (16:51.214)

It may be the case they view, hey, we take you out, you know, the cash flow that we’re able to generate from grabbing your business, you know, sufficient for our purposes, but you look at your business say, I want my employees to continue. want, you know, I’m intending to for this and my legacy to continue through this business. And so you want your lawyer, you want to hear things from your lawyer that suggest here’s what you should be thinking about while you enter into your deal. And then the last thing that I’d want to get a sense on

who exactly is going to be leading this transaction and who’s going to be doing the work? The reason is that, and I’m a law firm attorney, I just know the damn dynamics of how we prosecute these kinds of transactions. Some transactions are ones where you’re going to be able to demand the attention of the partner associated with the transaction. So that is the lawyer with the most experience in most cases. It’s not always the case that they’re the most experienced, but they may be.

And there are other transactions where it may actually be beneficial for some of their associates, a talent, some of the younger talent to be doing a lot of the work with the transaction. You want to get a sense, how do they want to approach it? And what are the fees associated with those folks? What can they provide an estimate on what they believe those fees are? And you want the approach to make sense to you. In many cases, or particularly smaller companies,

Entrepreneurs want the most senior person on the deal close to them that they can ask questions to. They want to be walked through this. It’s their first &A deal and it makes complete sense. You should pick the team that gives you that confidence because at the end of the day, you will be reliant very heavily for your own sanity on having confidence in your legal team. So I think those are the three key things I would ask. OK, great.

I know it’s very different, but let’s just say in our industry, the typical size range of company might be two million to say $8 million. So if that’s the case, percent of what dollars should somebody set aside to do a transaction with you or with your firm? Absolutely. And so I think this is likely going to apply to my firm. And you know, some firms may disagree. I think this will apply pretty commonly across the legal industry.

Pearl Collective (19:14.798)

I would say take your transaction, what you believe to be your transaction value. So if you are an $8 million company or a $10 million company, and you would say, what is between maybe 0 .5 % to about 2 % of the transaction, that’s probably going to be your legal fees. If you’re on the smaller end, we get a little bit closer between 1 .5 % to 2%. If you are closer to $8 million or $10 million,

you’re more likely to be around 1 % or less. I’ve done a $2 million deal this year. We came in somewhere just under 1 % ultimately than what we charged. And some of this also is dependent on what kind of transaction you’re entering into. If ultimately you’re entering into a transaction where the sale really is a management buyout. So you have really sophisticated

you know, really sophisticated management team, they want to take this business over for you. They may not need all of the same things that another buyer needs, in which case, you for our purposes, legal professionals, we don’t need to dig in with you or with the buyer about all of these same things. And so our fees are less. So depends on the trade, but I’d say 0 .5 to about 2 % is, you know, generally across the

Okay, great. At least it gives us a number to work with because there are so many people involved in this whole process that somebody needs to know before they go into the sale. What am I going to have to pay? How much do I have to pay upfront? How much do I have to pay at the end of the transaction just so they can plan and know what their exit dollars will be? Absolutely. Okay, so another question is prepping for the sale.

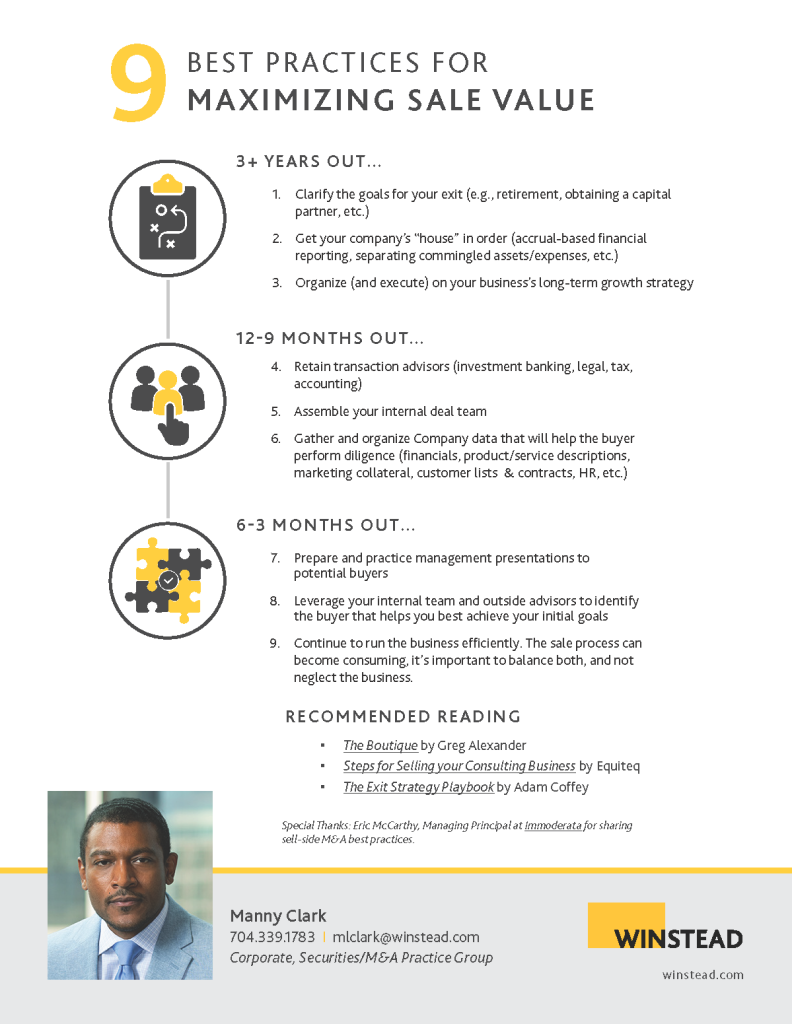

If you were to break it down, and I don’t know if 10 steps is the right number, but you can tell me what you think the right steps would be, what are the vital things to prepare? Absolutely. So, you know, I tried in preparing for this, I tried to prepare an infographic that I think may be helpful to your listeners. I’ve entitled it, 9 Best Practices for Maximizing Sale Value. I think you should be able to get alongside your show notes.

Pearl Collective (21:37.358)

And I’ll talk a little bit about this here, but I’ve broken it down into three sections. What you should be doing three years out from your sale, what you should be doing about a year out from your sale, and then what you should be doing roughly six to three months prior to your sale. What I would say at the forefront of this is that the single most important thing you should do is consider that you have to exit your business.

everyone will exit their business. so it is important at generally at the forefront, when you establish your business or at some point you’re doing your career to consider what do I want my exit to look like? Who should be involved in it? Having those things in mind will help some of these other things come into focus. so that really, that’s the first point. It’s really understanding what is your exit strategy.

you know, to ultimately pass this business down to someone else, like a son or a daughter, or some person on your management team. Are you trying to seek maximal value, you know, out of the sale of your business? Are you, you know, potentially a person who says, I’m ready for the next go, I want to grow this to be so much bigger. And in actuality, I think what I really need is a capital partner. Getting that clarity will help determine quite a lot about what your ultimate exit looks

and will help also shade how you direct your business for the future. So that’s the first point and the first item. Point number two is getting your house in order. Getting your house in order is about doing all of the cleanup things you need to do to prepare for a sale. I think firstly and primarily is the case that among lower middle market businesses and lower middle market is these are generally company between five million to $50 million.

of annual revenue. Among those businesses, it is often the case that they are operating with the intention of doing financial reporting that is for their taxes. And it is to reduce ultimately their tax burden every year. And that’s fine insofar as you’re not trying to sell your business. But when you’re trying to sell your business, you want to be as clear with the buyer about, here is how I choose revenue.

Pearl Collective (24:02.412)

you know, here is the certainty you can have with respect to that revenue. Here are my expenses. And you want to do it in such a way that is generally accepted by the buyer. And the way that we often counsel clients is if you’re going to prepare for a serial transaction, one, if you’ve been using tax basis or cash basis accounting, you really need to move to an accrual accounting system and try and get

your financials in line with GAAP. Often we will recommend to clients and sometimes they are not happy about the costs associated with it or the timing, but audited financials are the best way to do that. Audited financials, apologize. So these audited financials, so that is having an independent public accounting firm come in, review your financials to ensure that they are in compliance with

they go through an exhaustive process to be able to do that and ultimately produce an audit report. When a buyer sees an audit report, they understand the seriousness of the seller. This is a seller who has been maintaining their books in a way that they can want, that has the attestation of an outside accounting firm, and they can put a lot of trust in the financials associated with the business. So I’d say that’s a primary item of getting your house in order. And then it

there are kind of things you may need to do as a seller of a smaller business. Sometimes sellers will commingle assets a bit. So maybe you’ve been running your business out of real estate that you go into on the side. Or alternatively, if you have a car that either the business pays for, getting some of those things out, taking some of these things off of the balance sheet, this is a good practice prior to your sale. Some buyers are willing to deal with it, some are not.

But separating them out, think it’s helpful. And then, moving into the third step, it’s really organizing your business so that it helps to implement your long -term growth strategy. So that is, you ultimately need to understand how is your business grows? How do you achieve more customers? How do you achieve more revenue? And in the three -year period prior to selling, you wanna execute on that such that when you come before a buyer, you can say,

Pearl Collective (26:26.638)

Here’s how we’ve executed. Here’s how we’ve grown. And here’s how I can pass the business to you and what you can look forward to in terms of future growth. So I think those are the first three points. We’ve touched on some of the others in the second section about what you do in 12 to nine months out. You wanna retain professional transaction advisors. Another important item here is you want to get a professional internal deal team. That doesn’t have to be all your employees.

It can be select employees. can be someone, one employee who you feel is very close to you. The reason I recommend this is that the sale process is daunting. It will take up a lot of your time. It can distract you from the business. It is very often the case that businesses following the sale may suffer a bit because the owner has been distracted trying to implement the sale. And so it’s important to have people who you can delegate to and say,

Hey, I need you to handle this while I’m handling this part of the sale process. Or maybe this isn’t a part of the sale process I should touch. Maybe I have an internal expert who can deal with this item. Those people can help you implement the next item, which is number six within the infographic, which is helping you just gather and organize things to get ready for the sale. From there, the last three things you should do six to three months out. One, you’ve got to nail.

your management presentations with potential buyers. They care. You know, they care about these management presentations. They make judgments about whether to buy companies based on the success of those presentations. And the presentations themselves are not merely what you present, you know, in a formal meeting with the buyer. It is also how you and your company behave off the clock when you are attending dinners, you know, with buyer parties. It’s important that you get that

because it ultimately helps you get the best offers and determines if there are offers out there to get. From there, in connection with the process, is once you’ve set up your internal team, it’s leveraging them throughout the process. You will find at some point that you’ll get exhausted. We got a term for it within the law, which is deal fatigue. And it hits generally around the same time. Every deal, it’s about a

Pearl Collective (28:54.668)

to three weeks prior to a deal closing. There’s deal fatigue and it’s real and sellers experience it in a number of different ways. Some walk and say, or I wanna walk from a deal. Some cave on positions they may have otherwise felt strong about. Having that internal deal team to support you emotionally, as well as physically with doing things that’s so important. And then finally, is continue to keep your eye on the ball with respect to the business.

You have to continue to run the business efficiently, not only to help meet the goals of the sale so that you can achieve everything you’re looking to achieve from your purchase price, but additionally putting your business in the place such that when the buyer inherits it, they’re able to achieve what they need to, particularly if you have something like an earn out, which is functional, it’s an agreement that they will pay you based on future success with business. So those are my nine keys. I’ve also got a couple of books as recommended reading.

in there and a few articles. so I definitely would recommend to your readers, take a look at it. I think there’s, I’ve got a little bit of wisdom and then there’s a lot of wisdom in those books. Well, I think a lot of wisdom on your part and I love that. The answers you’re giving, very, very helpful and tactical, which is perfect for this. What are some of the biggest mistakes you see business owners make in the sale process? Absolutely.

The single biggest I’ve actually seen tends to relate to the tax planning. This is very often a multi -million dollar mistake, unfortunately, particularly for folks within the professional services industries. I would say one, if you are a seller and there are many sellers who I would imagine are architecture, interior design firms who have elected to be S corporations, I want to counsel you right

go and talk to the tax advisor and ensure that you and your tax advisor feel comfortable with your historical reporting and your tax practices, your corporate and organizational documents. The reason I say this is I have encountered even recently on transactions, sellers defaulting their S -elections. And so that is your election to be an S -corp and it can result in disastrous consequences in connection with the deal. Some deals will just not close. The buyers will walk away.

Pearl Collective (31:15.596)

because of the tax issues associated with them. And some will ultimately price much lower in the course of the deal. So that is tax planning is key. And I have seen sellers mess that up. I would say, the next one may be misalignment among stakeholders or shareholders within the firm. So if it is the case that you’re on the out with some of your partners and you’re considering a sales transaction, this may be a good time to find a way to get back in with

Because to the extent that they have any ability to demand something in connection with the sale, they’re probably. And we’ve seen that in transactions and it can become emotionally very difficult. Negotiations can be difficult. And additionally, you have a buyer party maybe on the other side saying what is going on. And so it’s crucial that you try and gain as much alignment as you can.

And it may not just be other shareholders or partners, sometimes it’s key employees of the business. It’s, know, assuring them, here’s what we think your place is going to be within this new organization. Here’s what we need you to do. Companies that have the strongest sellers like have this, like there’s no question about it. And we move forward really quickly. The ones that don’t, that’s where we see quite a lot of deal, you know, issues. And oftentimes we see an owner having to make concessions that they wouldn’t.

otherwise have to make with that kind of stakeholder. And then I think it’s really just planning failures with respect to the sale process itself, which is one of that thing. It’s hiring advisors too late or starting on the sale process too late. Starting with sale process too late really being if you’ve not truly considered how your exit will look in the future, when you want that exit to happen, it can sometimes find you.

And sometimes the way it finds you is, hey, your business is doing, you know, it’s returning poorly enough that you feel you may need to seek a sale. And in those situations, buyers, you know, understand that you may not have other options and they approach you with offers that contemplate that. Otherwise not planning to be hiring advisors too late. You know, if I’m hired,

Pearl Collective (33:38.996)

after the LL. I. period, it’s not the case that I can do much with what the deal will look like. So we may have been able to fight for a deal that didn’t involve a really significant chunk of your exit proceeds being treated according to ordinary as ordinary income, is you basically for your personal tax purposes taking that income at one of the highest individual tax rates.

We could fight for that, you know, prior to an LOI and after an LOI, some buyers are really low to retrade. So it’s important to plan for this, grab your body early, you know, be in a position to be knowledgeable about all aspects of your deal and be proactive. I think those are the key, you know, key items that CCOs fail on. You know, but I’m hopeful after

that the creative genius listeners will not be among them. Let’s hope not. All right. So the statistic is not very good for the number of businesses that sell. I think it was something like 20 % overall, which is not very many. And I’d like to know why that is and what can be done to ensure that a seller is able to go through the process and have a successful exit. Yeah, there are, I would say,

probably macroeconomic and other forces that attend why that is the case. One, a lot of businesses fail. I think the statistic that’s thrown around is most businesses actually shutter. Like 80 % of businesses will shutter really quickly after they’re ultimately formed. So think that’s one way that takes out the majority of potential businesses that could see an exit transaction.

For smaller businesses, will say finding a potential buyer willing to write a small check or a check that is appropriate for the size of a smaller business may be difficult or may be difficult to find as a sale at the market value of the business rather than another kind of sale. Like for example, an aqua hire transaction where the buyer says,

Pearl Collective (36:03.114)

you just don’t make enough, you know, for me to really buy your business. I take people. We’ll take what I take your I take your people. I will take the folks associated with your business and bring them on as employees. But I might not buy the business yourself. It is, you know, I am preparing for this. I read some of the materials that I suggested within the the nine tips

You know, of the folks there are private equity investors and they know we are sometimes loathe to write those kind of those checks for smaller businesses. They would rather see a business that has grown and is robust, has reached the growth stage of its business cycle rather than emerging companies. smaller businesses, it’s just hard to write those checks because ultimately this is a business that has not yet achieved sustained profitability. So that’s why a lot of sellers don’t see their exits.

So the reality is to combat that. You know, I think one for sellers is prepare early, you know, and really understand a growth strategy and execute on that growth strategy. And there are a lot of different ways that you can execute. It’s not just simply customer acquisition. There’s, you know, quite a number of commentators who say you should, you know, seriously be considering, you know, buying versus building.

So that is going out and doing some acquisitions on your own. And there are capital providers who will assist with that. But implementing that growth strategy so that you can get to a place that you’re an attractive exit option, I think that’s the key. Interesting. OK. Well, that’s a good one. What I realized is you have so much information here.

I would love to ask you if you would do a second interview so that we can get to the last section of these questions at that point. And why don’t we then end this session today with three takeaways from what you shared earlier in this session. Yeah, absolutely. And thank you again for having me on. think the most important takeaway, number one, is you need to be planning on this from the beginning.

Pearl Collective (38:26.378)

And so maybe it’s the beginning of the business. If that’s not the case for you as a seller, then you make it the case now. What do I want my exit to look like? How do I want it to look like? And that is going to help you make decisions about what kind of advisors you seek, what kind of buyers you’re looking at. so taking that opportunity now will help you get to that place. I think number two

you know, likely it’s finding, going out and trying to find those advisors to help you to get to those places. There are, you know, and I know folks who are sometimes love to go out and grab, you know, an outside consultant or an investment banker, you know, and, and really talk about how do I get to growth, you know, within my business, but they’ve got great ideas. And, you know, seeking them for their great ideas, seeking them for advice about, you know, how

implement my growth strategy, how I develop a growth strategy is important. And I think it helps companies get to a place where they’re able to actually exit. And they’re not just simply shuttering their business. And then finally, it is in connection with a sale process. It’s ensuring that you have already built around you a team of internal and external advisors who are aligned.

on your ultimate exit strategy. And that alignment piece is key. Not only do you ensure that your folks internally are helping you drive there, but that everyone is getting what they’re looking for out of the transaction and no one is seeking something different. We’re all rolling in the same direction. Awesome. Well, this has been so enlightening and there is so much need in what you just shared with us today.

Definitely will be in touch and we will be have you back on the podcast for the second section. But thank you again for your time today, Manny. You were just outstanding. And I again learned so much just in that short conversation. Well, I really appreciate the opportunity, Gail. It’s my pleasure. I very much look forward to coming back and talking more. All right. Thank you again. Take care, Manny. Take care.

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast