The Tom Dupree Show

Interest Rates are up and Inflation is Starting to Ease Part 1

It is important for your retirement nest egg to have a well-established inflation hedge.

We realize that you might just be sick of hearing and reading about inflation by now.

It is everywhere you look, and we just seem to keep talking about it.

But there is a big reason why we just can’t prevent ourselves from reminding you about that 400 lb. gorilla lurking around seemingly every corner.

We will keep bringing it up because my #1 priority is to invest in such things that provide enough investment income for our clients to offset the impacts of inflation as they enter retirement and live off their savings during this period of their lives.

This isn’t magic, it is the way real wealth creation in the United States is accomplished. And it is the way that it has been done since the foundation of our capital markets.

So how exactly are equities a hedge against inflation?

Has history shown us that, in fact, equity investments have proven to be a safe haven against the inflation of our currency?

Unequivocally… Yes!

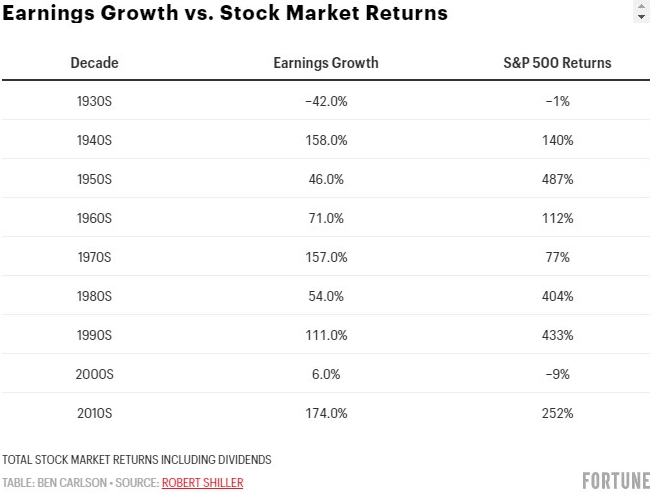

Corporate Earnings Growth is a Powerful Inflation Hedge

In the short term, there can become a disconnect between real corporate earnings expansion and the underlying value of stocks.

The stock market goes up and down, but quality companies have endured all economic climates.

“In the short run the stock market is a voting machine, in the long run, it is a weighing machine” – Benjamin Graham

A quick dive into history proves that companies with pricing power can achieve strong earnings growth during periods of high inflation.

The 1970s marked the era of stagflation. For lack of a better term, inflation was off the charts. So much so that, by the end of the decade, it would have taken nearly $168 to purchase the same amount of goods that $100 would have purchased just 10 years earlier. Yes, there were some bad years in the market during that decade. However, every dollar invested would have been worth $177 had it been invested in the S&P 500 during this same timeframe.

Even more glaring was the real earnings growth in those same companies. This decade saw corporate earnings expand by 157%! This earnings growth helped set the stage for the recovery and expansion of the 1980s when the S&P 500 was up over 400% despite corporate earnings growth being only 54% during the decade.

How did companies with pricing power achieve such tremendous earnings growth through such a calamitous economic climate?

It’s simple!

Those companies were able to pass their increased costs on to consumers. And that is precisely how, over the long run, investing in quality companies is a tremendous hedge against inflation.

Actual Equity Returns Compared to Inflation

How does this pricing power ultimately perform in the long term?

Quite well it turns out.

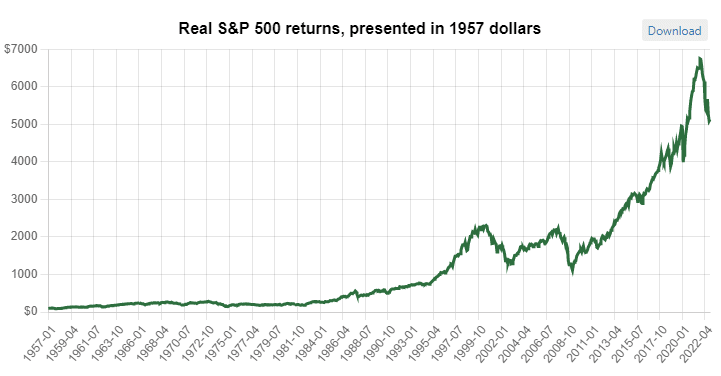

If you would have invested $1 in the S&P 500 when it originated in 1957, it would have been worth over $720 at the end of October 2022. That is a compounded annual growth rate of over 10.2%. And that is if you had only invested in the index which forces you to sell low and buy high.

Throughout those 65 years, we have had large spikes in inflation on numerous occasions. Adjusted for inflation, your money would have realized a mouth-watering CAGR approximating 6.8%.

But in the investing world, that is a very long time. What about recent history?

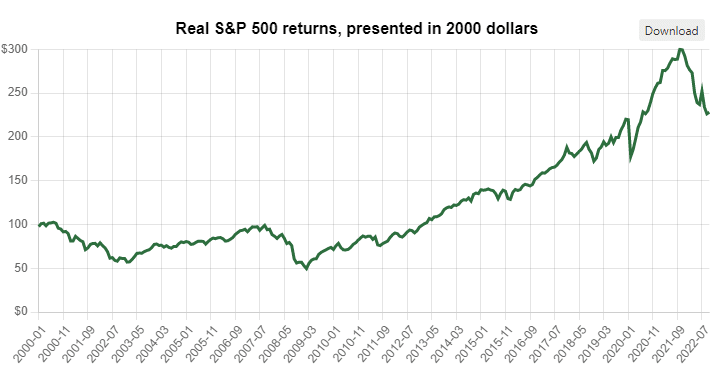

Despite the Volatility Since 2000, US Equities Have Been Strong

Since 2000, the world has gone through much turmoil and upheaval.

At the onset of this century, we had a major correction from the bursting of the dotcom tech bubble. This period saw the NASDAQ fall more than 75% from March of 2000 to October of 2002 wiping out $5 trillion in assets. The S&P 500 fared better but the index still fell by 50%. Not a great start to the 21st Century.

Then again in 2007-2009, another crisis impacted the markets, the Global Financial Crisis. During this less-than-stellar run, the S&P 500 fell by more than 46%.

Then 2020 happened and we found ourselves in the midst of a panic of a new sort. The economy shuddered in the wake of a global pandemic. Countries the world over essentially shut down. Workers still find themselves working from home, and the toilet paper supply has only recently recovered. From the onset of the pandemic, the markets sold off in a big way. The S&P 500 fell nearly 35% from February 19, 2020 to March 23, 2022.

Despite all of this upheaval so far in this century, the market as a whole has still proven resilient as an inflation hedge.

From January 1, 2000, through the end of 2021, the S&P 500 has achieved a compounded annual growth rate including dividends exceeding 7.5%. Adjusted for inflation, this has worked out favorably for patient investors. Through all the turmoil that has caused volatility in equity markets in the last 20+ years, investors wisely utilizing US equities as an inflation hedge have seen their assets grow. The average annual rate after accounting for all inflation has still been a whopping 5.08% even at the end of 2021.

What About Gold As an Inflation Hedge?

Oftentimes, when investors think of an investment that is a hedge against inflation they turn to precious metals like gold and, to a lesser extent, silver.

We don’t have a problem with gold. It is pretty to look at, it does have a store of value, and it makes fine jewelry. Looking at it from an investment standpoint, however, its shiny appeal quickly fades.

If we bought 10 ounces of gold and put it in a safe deposit box, we would have no more than exactly 10 ounces when I check back on it 10 years from now. It wouldn’t create more gold, or even give birth to an ounce of silver. Now, the underlying price in dollars might be more. But that would be about it.

But how has gold worked as a hedge against inflation?

Not as well as you might think!

Let’s take a look at the correlation.

For you non-statistic nerds, correlation is a statistical metric that compares the relationship between two things. The closer that correlation is to 1 the more those two things move in tandem with one another. Therefore, if gold was a perfect hedge against inflation, the correlation between inflation and gold would be exactly 1. But what is the correlation? It turns out it is way less than 1. It is only 0.16 so it turns out it isn’t that great of a hedge.

In fact, if you look at the period from 1980-1984 annual inflation averaged 6.5% while gold fell about 10% per year during this period. From 1988 – 1991 we saw another period of inflation averaging in excess of 4.5%. What happened to gold? It fell by an average of over 7.5% on average.

There could be a decent case for having precious metals as part of a diversification strategy. During bear markets, there does seem to be a negative correlation between precious metals and the stock market as a whole. But do not expect your gold to appreciate lockstep with inflation.

There proves no better hedge against inflation than the good old stock market.

Asher Rogovy, chief investment officer at Magnifina, backs me up on this stating that the best inflation hedge has been the equities market.

“I’m always surprised how often investors forget that plain old stocks hedge against inflation over the long term. Of course, stock valuations may fluctuate with the day’s economic news, but across multiple business cycles, market indices have significantly outperformed inflation.”

Learn More with Dupree Financial Group

I understand that the market can be scary for many investors.

With the daily news cycle constantly lambasting you with inflation numbers that we haven’t seen for over 40 years, it can cause fear and anxiety.

Dupree Financial Group, LLC takes a value-oriented approach to investing. We invest our clients’ money in companies that stand the test of time. Research is at the heart of everything we do as a company. And it is this research that gives us the confidence to take advantage of any pullbacks that might occur along the way.

Contact us today for a no-obligation consultation. Give yourself the mettle to stay the course and sit down with us today.

The post Looking For a Great Inflation Hedge? Look No Further than US Equities! appeared first on Dupree Financial.

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast