Not Your Average Financial Podcast™

Episode 231: Top 10 Episodes! How Is Guaranteed Growth Possible? (Ep. 197)

Would you like to hear 10 of THE BEST episodes so far?

How can certain whole life insurance polices grow on a GUARANTEED basis?

In this episode, we ask:

- What about Silly Putty?

- What about accidental inventions?

- What about the wheel?

- What about the axle?

- What about the power of leverage?

- What about access?

- What about cash value?

- What about a contract?

- What about Bank on Yourself® type whole life insurance contracts?

- What about Episode 195 and Episode 196?

- How can whole life insurance grow guaranteed?

- How long might you live?

- What affects guaranteed growth?

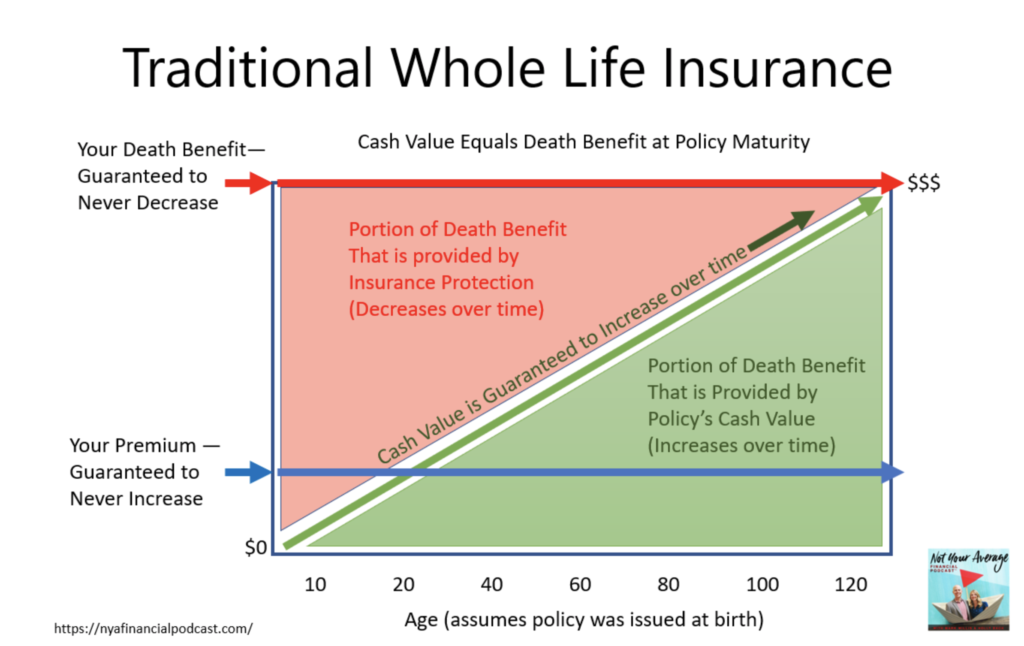

- What about traditional whole life insurance?

- What about the guaranteed death benefits at mortality?

- What about financial certainty?

- What about greater flexibility?

- What is powerful and often overlooked?

- What about the average ways of looking at finances?

- What about “mythical financial vehicles”?

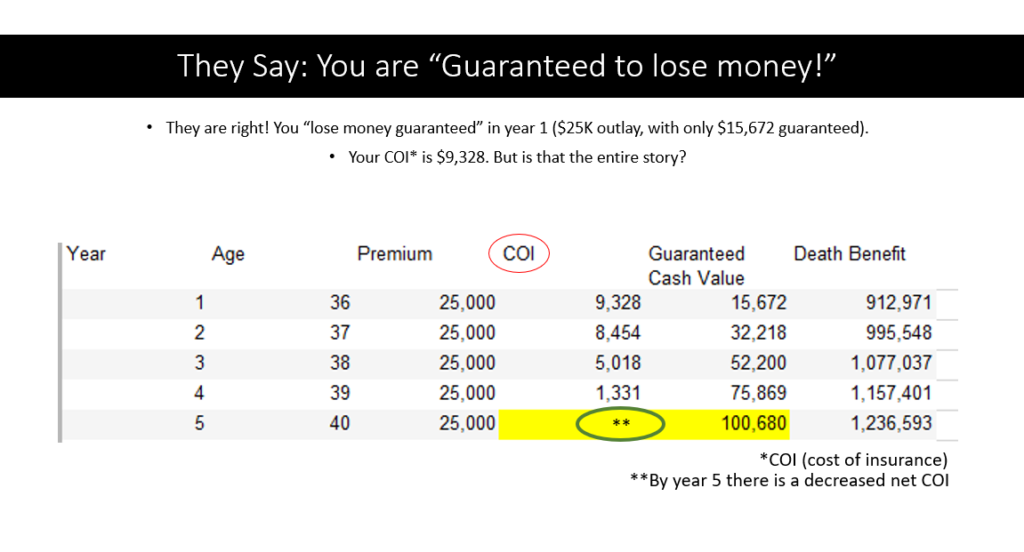

- Are you guaranteed to lose money if you buy whole life insurance?

- What happens in year 1 of a permanent whole life insurance policy?

- What about some context?

- What about whole life insurance compared to ETFs or bond fund?

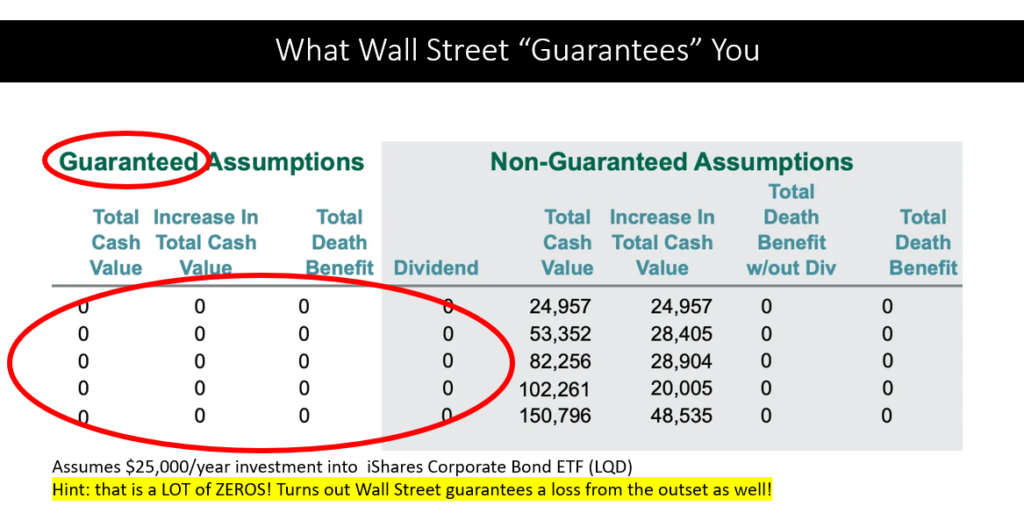

- Is there a guaranteed ledger in the stock market? (NO!)

- What about the guaranteed LOSS for the stock market investor?

- What about the objections?

- What about the dividends?

- What about timing?

- Does timing matter?

- What about fluctuating markets?

- What about risk?

- What about success in retirement?

- What three things does whole life insurance provide?

- What about guaranteed income that cannot be outlived?

- What about access to mortality credits?

- How are mortality credits like the axle?

- How might insurance companies make a profit?

- What are mortality tables?

- What about hedging risk?

- What about Paid Up Additions riders or PUAs?

- Would you like to hear Episode 142?

- What about leverage?

- What about pennies that buy dollars?

- What about volatility?

- What about little or no volatility?

- How might you dramatically reduce your risk?

- What about the barbell?

- When is the greatest time to have cash value whole life insurance and annuities in your portfolio?

- What about getting greater yield?

- What about examples?

- What about CDs?

- What about annuities?

- What about death benefits?

- What about super low interest rate environments?

- What about privacy?

- What about going through probate (or not)?

- What about beneficiaries?

- What about creditor and predator protection?

- What about the power of the axle?

- Would you like to listen to Sarry’s podcast as well?

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast