Grains & Oilseeds with Craig Turner

Turner’s Take Podcast | Ag Forum Next Week

Play Turner’s Take Ag Marketing Podcast Episode 300

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

NEW PODCAST

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

In this week’s podcast we go over Russian/Ukraine, US inflation, and they impact the macro markets. Then we switch gears to next week’s Ag Forum and what it means for the grain and oilseed markets. The Ag Forum will give us the USDA’s first look at new crop acres, trend line yields, and demand figures. We are very interested to see how the USDA accounts for the lost demand in S. America and how it finds its way into the to the US balance sheets for old crop or new crop exports. Soybean oil projections for biodiesel production will be another big data point to review. Make sure you take a listen to this week’s Turner’s Take podcast.

Click here to open an account with Craig Turner & StoneX today!

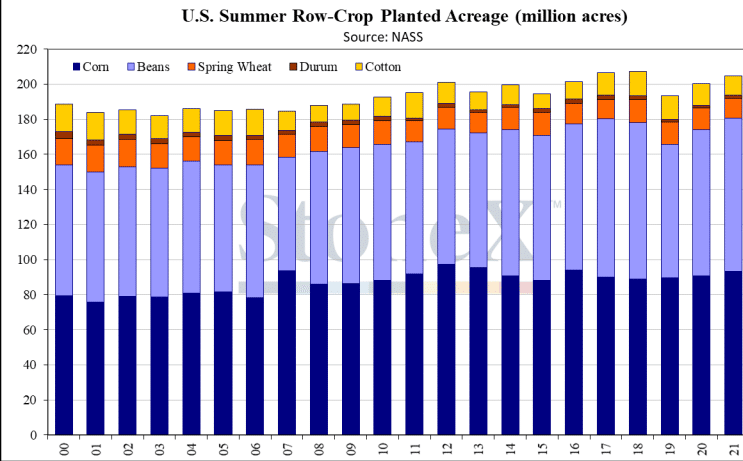

AG FORUM

The USDA’s 2022 Ag Forum is 2/24 and 2/25. This is a big report for a couple of reasons. The first is we get to see USDA estimates for new crop acres. The second is we get to see what the USDA thinks about new crop demand. We don’t see a planted acres report again until the end of March and we don’t get to see a new crop balance sheet until the May WASDE. Below is a chart of US Summer Row-Crop Panted Acres. The chart includes corn, soybeans, spring wheat, durum, and cotton. One of our themes has been there is not enough new crop acres to be around. All of these markets have high prices, tight balance sheets, and a need for more acres. It will be interesting to see if the mix stays the same or if the USDA thinks there might be one winner (or loser).

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Subscribe to Turner’s Take Newsletter & Podcast

Turner’s Take Newsletter & Podcast – Turner’s Take is a complimentary weekly market commentary newsletter that covers the Grain, Livestock and Energy futures spread markets using fundamental, technical and seasonal analysis.

Subscribe to Turner’s Take Newsletter & Podcast

Learn More

View a Sample

Contact Daniels Trading

To open an account or request more information, contact us at (800) 800-3840 or info@danielstrading.com and mention Craig Turner.

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2022 StoneX Group Inc. All Rights Reserved

Craig Turner is a Senior Broker at Daniels Trading, author of Turner’s Take newsletter, and a Contributing Editor for Grain Analyst. Craig is often quoted in the Wall Street Journal, Reuters, Dow Jones Newswire, Corn & Soybean Digest, and also makes appearances on SiriusXM – Rural Radio Channel 80 providing commentary for the Grain and Livestock markets. Craig has also been featured in FutureSource’s Fast Break series, Futures Magazine Online, and INO.com. Mr. Turner has a Bachelors from the Rensselaer Polytechnic Institute (RPI) where he graduated with honors and has worked at the NYSE and Goldman Sachs. While at Goldman, Craig earned his MBA in the NYU Stern executive program. Learn more about Craig Turner.

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast