Money Talk Podcast

Money Talk Podcast, Friday Dec. 13, 2024

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Dec. 9-13, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

The Bureau of Labor Statistics said worker productivity rose at an annual rate of 2.2% in the third quarter, unchanged from an earlier estimate. Measured year over year, productivity advanced 2% from the third quarter of 2023. That compares to an average 1.5% annual gain since the end of 2019, which is below the 2.1% average since 1947. The productivity report showed unit labor costs running at a 0.8% annual pace during the latest quarter, down from an initial estimate of 1.9%. Adjusted for inflation, labor costs rose 1.6% from the third quarter of 2023.

Wednesday

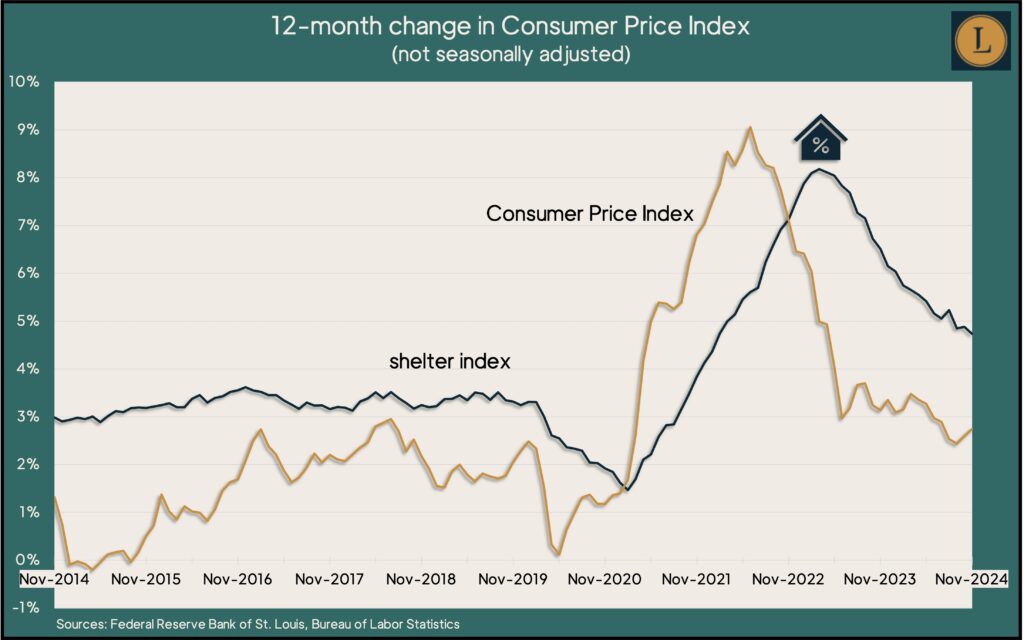

The broadest measure of inflation ticked up in November, increasing on a year-to-year rate to 2.7%. The Bureau of Labor Statistics reported that the Consumer Price Index accelerated for the second month in a row, still above the long-range Federal Reserve target of 2% but down from a four-decade high of 9.1% in June 2022. The CPI added 0.3% from October with shelter costs accounting for 40% of the gain. In the previous 12 months, shelter costs grew 4.7%, though that was the lowest increase in nearly three years. Excluding volatile costs for energy and food, the core CPI rose 3.3% from the year before for the third month in a row.

Thursday

Inflation on the wholesale level rose in November, as the Producer Price Index gained 0.4% from October, its largest increase since June. The Bureau of Labor Statistics said the cost of goods accounted for 60% of the PPI gain, mostly because of higher food prices, led by eggs. Compared to the year before, the index rose 3%, the most since early 2023. Excluding food, energy and trade services, the core PPI rose 3.5% from the year before for the fourth time in five months.

The four-week moving average for initial unemployment claims rose for the second week in a row but remained 38% below its 57-year average. The Labor Department reported that total claims fell 3.6% from the week before to fewer than 1.7 million. That was nearly 10% lower than the year before, suggesting employers overall continue to be reluctant to let workers go.

Friday

No major announcements

Market Closings for the Week

- Nasdaq – 19927, up 67points or 0.3%

- Standard & Poor’s 500 – 6051, down 39 or 0.6%

- Dow Jones Industrial – 43828, down 814 points or 1.8%

- 10-year U.S. Treasury Note – 4.40%, up 0.25 point

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast