Money Talk Podcast

Money Talk Podcast, Friday Dec. 6, 2024

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Dec. 2-6, 2024)

Significant Economic Indicators & Reports

Monday

The manufacturing shrank in November for the eighth month in a row and the 24th time in 25 months, according to the Institute for Supply Management. The trade group said manufacturers continued to experience soft demand, though new orders grew, and the overall index rose to its highest reading since June. The trade group said that based on past history, its index suggests the U.S. economy is growing at an annual rate of 1.7%.

The Commerce Department said the annual pace of construction spending rose 0.4% in October. Residential spending, which accounts for more than 40% of the total, rose 1.5% from September, all because of increased expenditures on single-family housing. Compared to October 2023, total construction spending rose nearly 5%, including a 6.4% increase in residential spending and a 16.6% gain in manufacturing spending.

Tuesday

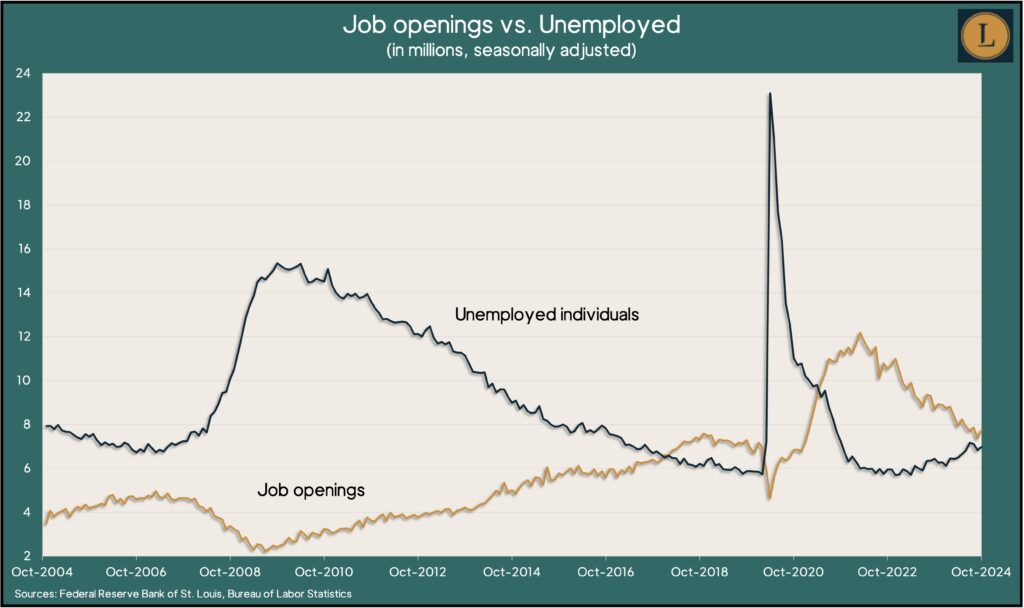

Employers’ appetite for new workers rose in October as job openings advance 5% to 7.7 million posts. The Bureau of Labor Statistics reported that openings remained above pre-pandemic levels, though they were down nearly 11% from the year before. Openings had reached a high of 12.2 million in early 2022. The balance between demand and the supply of unemployed job seekers stayed relatively close. The rate of workers quitting their jobs – a sign of worker confidence – gained from September but has been below the pre-COVID level for nearly a year.

Wednesday

Demand for manufactured goods improved in October, with factory orders rising for the first time in three months. Led by requests for commercial aircraft, orders gained 0.2% from September and were up 0.4% from October 2023. Excluding aircraft and other volatile transportation equipment, orders rose 0.1% for the month and were 1.4% higher than the year before, the Commerce Department reported. Orders for core capital goods, a measure of business investment, receded 0.2% from September and were up 0.5% from October 2022.

The service sector has returned to sustainable growth, according to the Institute for Supply Management. The trade group’s ISM services index expanded in November, though at a slower pace, marking the fifth month in a row of expansion and the 51st time in 54 months. The ISM said supply managers surveyed for the index are expressing caution over prospects for increased tariffs.

Thursday

The U.S. trade gap narrowed 12% to $73.8 billion in October. The value of exports shrank from September by 1.6%, led by automotive products. At the same time, imports declined 4%, led by computers. The Bureau of Economic Analysis said the trade deficit, which detracts from measures of economic output, grew 12% through the first 10 months of this year compared to the same period in 2023. In that time, exports grew nearly 4% and imports rose more than 5%.

The four-week moving average of initial unemployment claims rose for the first time in six weeks. Still, the numbers continued to suggest an overall reluctance to let workers go. Data from the Labor Department put the moving average for jobless applications at 40% below its 57-year average. Just over 1.7 million Americans claimed unemployment benefits in the latest week, up almost 4% from the week before, and nearly 11% more than the same time last year.

Friday

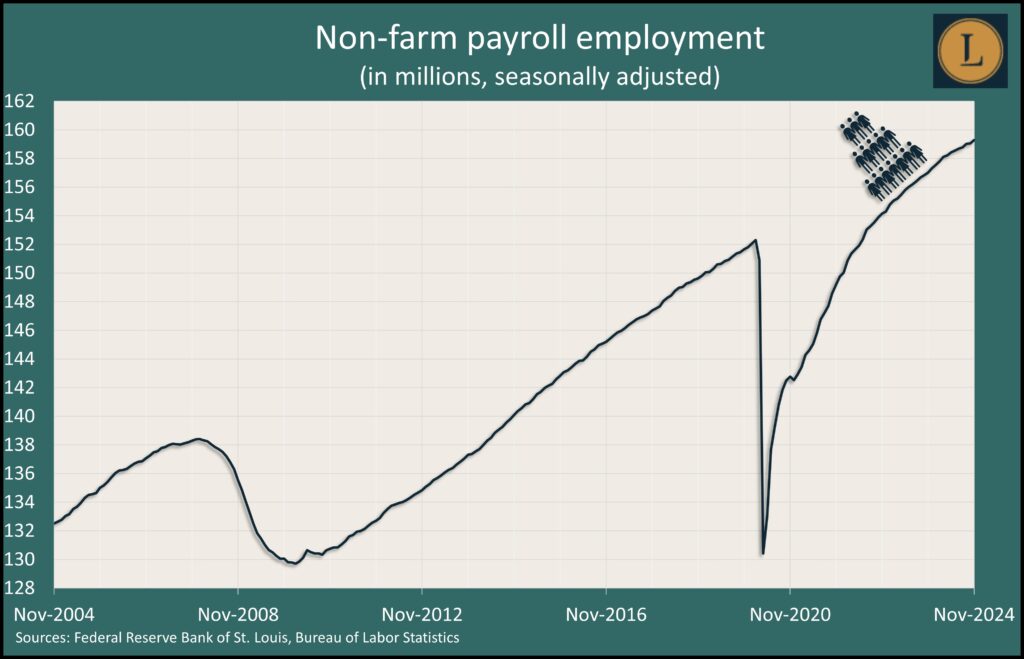

Employers continued to add jobs in November and at a brisker pace, while the unemployment rate ticked up. The latest employment report, from the Bureau of Labor Statistics, showed 227,000 more jobs in November, exceeding the 12-month average of 186,000, the 47th consecutive gain. Bar and restaurant employment expanded above pre-pandemic levels for the ninth month in a row. Temporary help – considered a harbinger of hiring trends – was below the pre-COVID number for the 16th consecutive month. The seasonally adjusted unemployment rate rose slightly to 4.2% from 4.1% In October. Unemployment was at 3.7% In November 2023, near the lowest levels since the 1960s.

Consumer sentiment continued to strengthen as a reflection of the overall economy, the University of Michigan reported. A preliminary look at survey data for December showed the university’s sentiment index had risen for the fifth month in a row to its highest level since April. The index was up 3.1% from November and 6.2% from December 2023. its all-time low in June 2022. The report noted that political partisanship continued to factor into individual expectations for the economy, with Republicans believing conditions will improve and Democrats expecting the worse.

Market Closings for the Week

- Nasdaq – 19860, up 642 points or 3.3%

- Standard & Poor’s 500 – 6090, up 58 or 1.0%

- Dow Jones Industrial – 44643, down 268 points or 0.6%

- 10-year U.S. Treasury Note – 4.15%, down 0.03 point

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast