Money Talk Podcast

Money Talk Podcast, Friday Nov. 22, 2024

(with Max Hoelzl and Joel Dresang engineered by Jason Scuglik)

Week in Review (Nov. 18-22, 2024)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

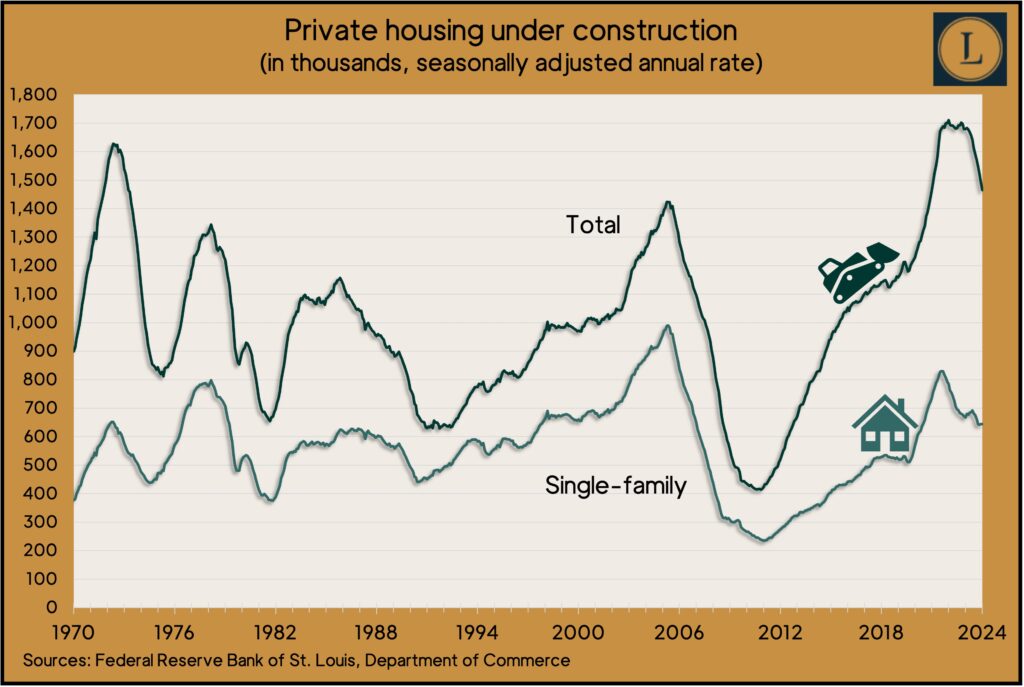

Housing construction data continued to show a slowdown in October, based on the annual pace of building permits and housing starts. A report from the Commerce Department showed both authorizations and starts stayed below their pre-pandemic pace. At the same time, the rate of housing units under construction remained around the highest since the mid-1970s, though it has slowed for 11 months in a row.

Wednesday

No major releases

Thursday

The four-week moving average for initial unemployment insurance claims declined for the fourth week in a row, dipping to its lowest point since early May, 40% below the 57-year average. The measure continued to indicate employers’ reluctance to let workers go. Total claims rose slightly to just under 1.7 million, up more than 4% from the same time last year.

The U.S. economy showed signs of challenges ahead as the Conference Board reported a steeper decline in its October index of leading economic indicators. The business research group reported a 0.4% drop in the index from September. The index had fallen 2.2% since April, down from a 2% decline in the prior six months. Manufacturing orders, factory hours, unemployment claims, building permits and a negative yield curve all pulled the index down in October, the Conference Board said.

The National Association of Realtors reported another decline in existing home sales in October. The annual sales rate dropped 3.4% from September to just below 4 million houses and condos. That was 2.9% ahead of the pace in October 2023, though, resulting in the first year-to-year improvement in sales since mid-2021. The trade group said rising inventories and a solid job market amid stabilizing mortgage rates could help housing demand. The median sales price rose to $407,200, which was up 4.2% from October 2023, the 16th consecutive year-to-year gain in prices.

Friday

Considered a precursor to spending, consumer sentiment, rose for the fourth month in a row in November. The longstanding index from the University of Michigan dipped slightly from a preliminary mid-month reading but rose 1.8% from October and was up 17% from November 2023. Outlooks on the economy and personal finances flip-flopped according to partisan affiliation following the Nov. 5 election, the university reported. Near-term expectations for inflation reached the lowest since the end of 2020, but long-term expectations for inflation rose slightly to 3.2%, reflecting increased uncertainty.

Market Closings for the Week

- Nasdaq – 19004, up 324 points or 1.7%

- Standard & Poor’s 500 – 5969, up 99 points or 1.7%

- Dow Jones Industrial – 44297, up 852 points or 2.0%

- 10-year U.S. Treasury Note – 4.41%, down 0.02 point

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast