Money Talk Podcast

Money Talk Podcast, Friday Nov. 15, 2024

(with Jason Scuglik and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Nov. 11-15, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

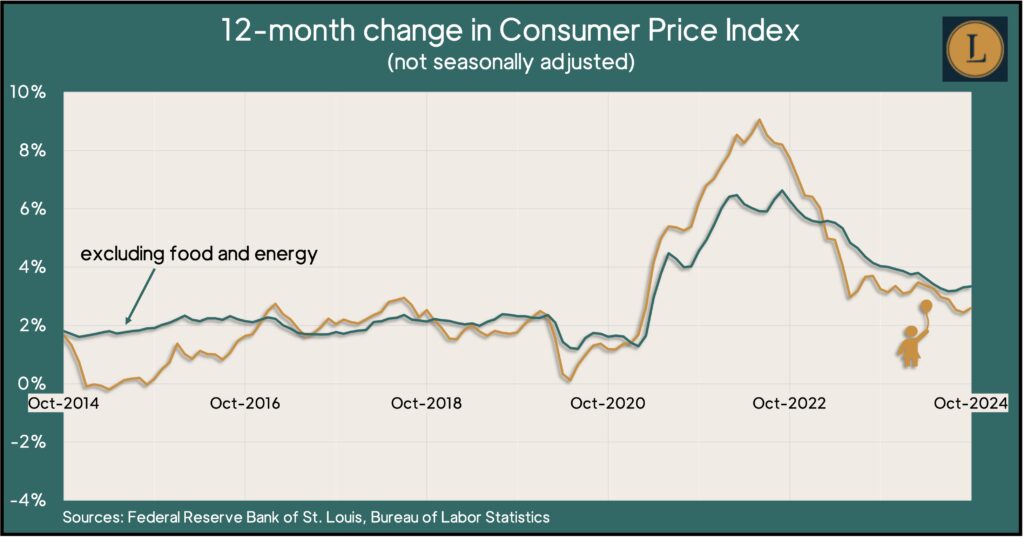

The pace of inflation rose in October for the first time in seven months. The Bureau of Labor Statistics reported that the Consumer Price Index, the broadest measure of inflation, increased 2.6% from the year before, up from September’s 2.4%, which was the smallest since February 2021. The index reached a four-decade high exceeding 9% in mid-2022. For the month, the CPI rose 0.2%, the same as the previous three months. Shelter costs accounted for more than half of the October increase. The core CPI, which strips out volatile food and energy prices, rose 3.3% from October 2023, the same pace as in September.

Thursday

Inflation on the wholesale level rose at a slightly faster pace in October, according to the Producer Price Index. The gauge gained 0.2% from September, the Bureau of Labor Statistics reported. The PPI rose 0.1% in September. The one-year wholesale inflation rate was 2.4%, up from 2.3% in September, but down from nearly 12% in the spring of 2022. Excluding volatile costs for food, energy and trade services, the so-called core PPI rose 3.5% from October 2023, up from 3.3% in September.

The four-week moving average for initial unemployment claims declined for the third week in a row to its lowest point since May, according to the Labor Department. The measure was 39% below the 57-year average, suggesting the relative tightness of the labor market. Total claims rose 1.9% in the latest week to more than 1.7 million, which was 2.4% higher than the year before.

Friday

Retail sales rose more than analysts expected in October. The Commerce Department reported that sales increased 0.3% from September, with eight of 13 categories reporting higher receipts, including car dealers, appliance centers and bars and restaurants. Since October 2023, total retail sales rose 2.8%, led by online retailers and car dealers. Adjusted for inflation, retail sales were up 0.2% from September.

The Federal Reserve reported a slight decline in industrial production in October, the second setback in a row and the third in four months. Striking workers at Boeing held back output by 0.2 percentage point while hurricanes Helene and MiIton subtracted 0.1 point from October’s production, the Fed said. Boeing settled its strike later in the month. Compared to October 2023, U.S. industrial output was down 0.3% and capacity utilization sank to 77.1%, the lowest in three and a half years.

Market Closings for the Week

- Nasdaq – 18680, down 607 points or 3.1%

- Standard & Poor’s 500 – 5871, down 125 points or 2.1%

- Dow Jones Industrial – 43445, down 544 points or 1.2%

- 10-year U.S. Treasury Note – 4.43%, up 0.12 point

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast