Money Talk Podcast

Money Talk Podcast, Friday Nov. 1, 2024

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Oct. 28-Nov. 1, 2024)

Significant Economic Indicators & Reports

Monday

No significant reports

Tuesday

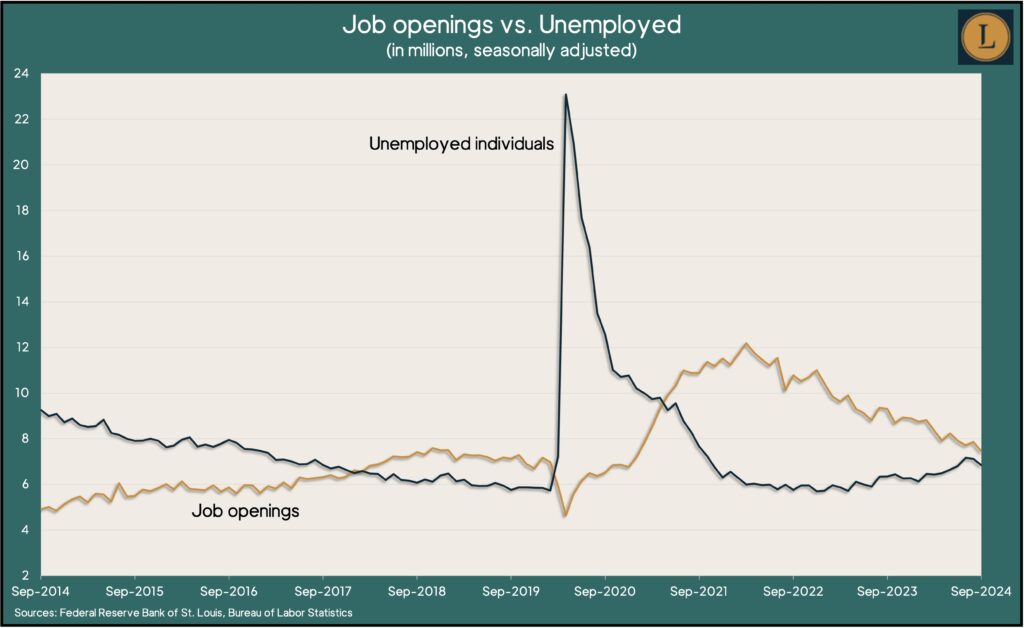

U.S. employers posted 7.4 million job openings in September, the fewest since the beginning of 2021. The demand for workers dropped from an all-time high of 12.2 million in mid-2022 but remained above the pre-pandemic level of 6.9 million, according to data from the Bureau of Labor Statistics. The number of workers quitting their jobs – a measure of confidence in finding new jobs – stayed below the pre-pandemic mark for the sixth month in a row.

Housing prices continued weakening in August, according to the S&P CoreLogic Case-Shiller national home price index. The measure showed the year-to-year gain in residential prices up 4.2%, down from 4.8% in July and the sixth consecutive deceleration. The index was at its lowest level in 11 months. A spokesperson for the index cited seasonal softening in demand as a factor.

The Conference Board said its consumer confidence index rose in October, registering the biggest boost since March 2021. Still, the business research group said consumer optimism remained within a narrow range that has persisted the past two years. Consumers showed greater confidence in both current conditions and expectations.

Wednesday

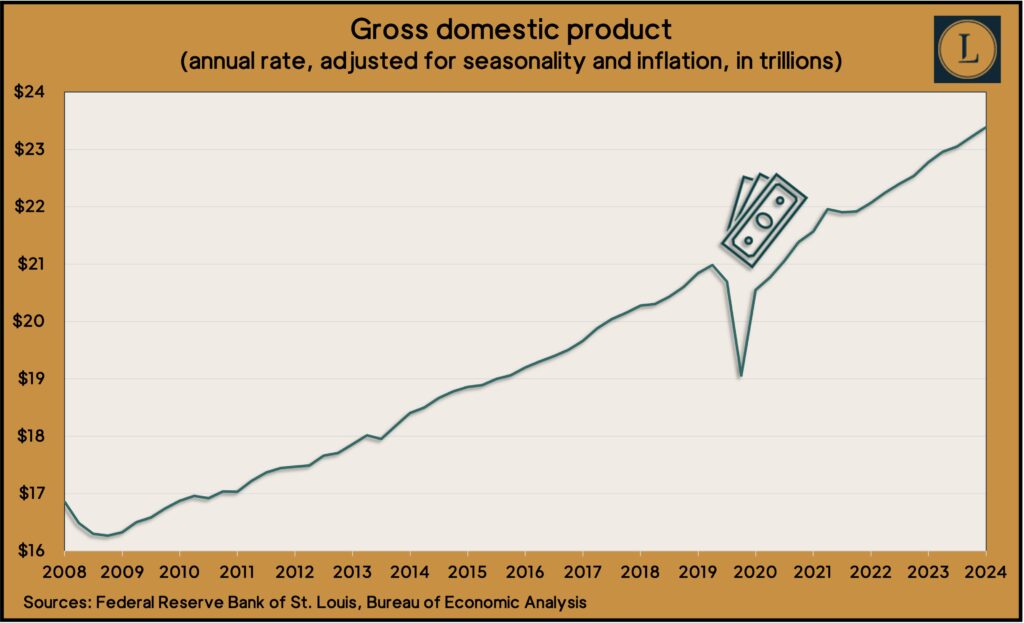

The U.S. economy rose at an annual pace of 2.8% in the third quarter, down from 3% in the second quarter. The Bureau of Economic Analysis said growth in gross domestic product slowed from a decline in business inventories and a bigger drop in housing investments. Consumer spending, which generates almost 70% of economic activity, advanced at a 3.7% annual rate, the highest since the beginning of 2023. Adjusted for inflation, GDP reached a record $23.4 trillion, up 2.7% from the year before.

The National Association of Realtors said its pending home sales index jumped 7.4% in September, boosted by higher inventory and lower mortgage rates. The index reached its highest point in six months and was up 2.6% from the year before but 24% below its 2001 base. The trade association said it expects further sales growth if employers continue hiring, inventories keep climbing and mortgage rates steady. The group forecast two years of recovery from recent sluggishness and said housing price increases should settle closer to overall inflation rates.

Thursday

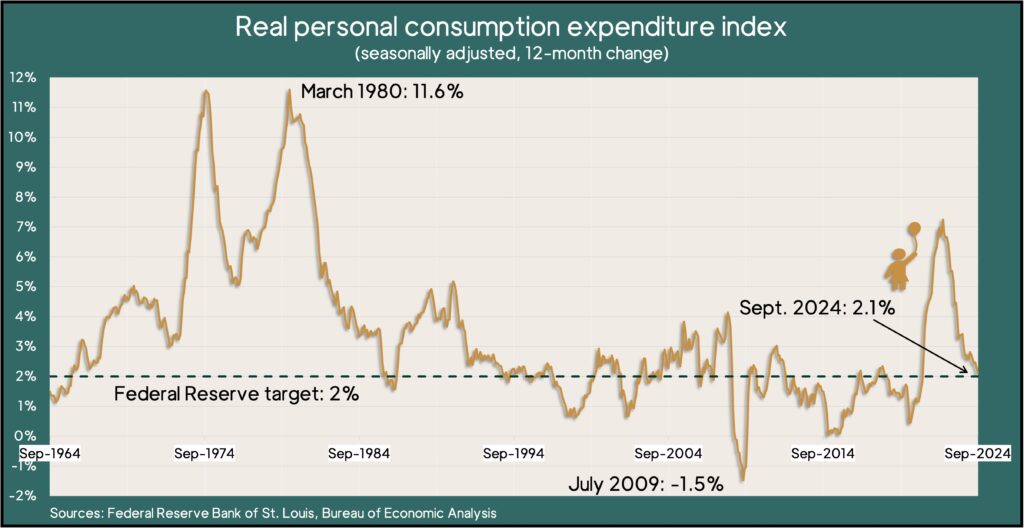

The Bureau of Economic Analysis said consumer spending rose 0.5% in September, as personal income gained 0.3%, lowering the personal saving rate to 4.6% of disposable income, the lowest since December. Consumer spending increased both in goods (led by pharmaceuticals and cars) and services (led by health care and housing). The personal consumption expenditures index, the Federal Reserve’s favorite measure for inflation, dropped to 2.1% from September 2023, the lowest since February 2021. That’s down from a 20-year high of 7.2% in June 2022 and near the Fed’s long-run target of 2%.

The four-week moving average for initial unemployment claims fell for the first time in four weeks, continuing to reflect an historically tight labor market. The measure was 35% below the all-time average, according to Labor Department data going back to 1967. The report said more than 1.6 million Americans claimed jobless benefits in the latest week, up nearly 2% from the week before and up 3% from the year before.

Friday

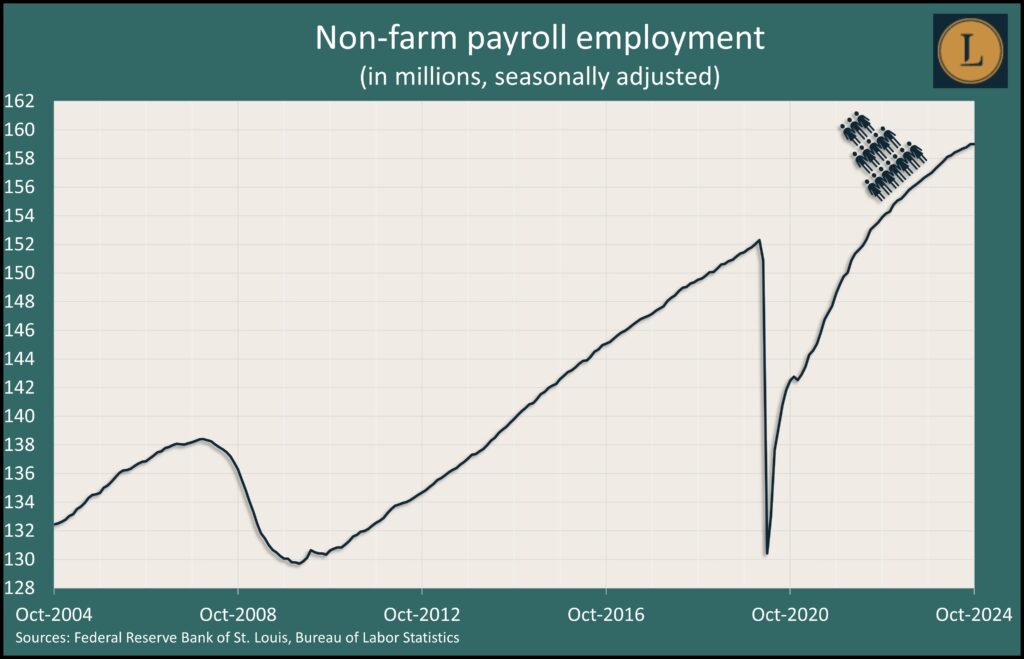

U.S. employers added 12,000 jobs in October and the unemployment rate stayed at 4.1%, according to a Bureau of Labor Statistics report clouded by two hurricanes and a couple of labor strikes. Employment rose for the 46th month in a row but far below the 12-month average of 194,000. The bureau revised August and September job counts down by 112,000, suggesting the labor market has been softening. The average wage rose 4% from the year before, continuing to outpace general inflation.

The manufacturing sector contracted in October for the 23rd time in 24 months, according to the Institute for Supply Management. The trade group’s index, based on surveys of industry purchasing managers, showed new orders and hiring declining at a slower rate while production dropped faster. The group said based on past index readings, GDP is growing at an annual rate of 1.1%.

The Commerce Department said construction spending rose slightly in September, aided by single-family housing. At a seasonally adjusted annual rate of more than $2 trillion, expenditures were up 0.1% from the August pace and up 4.6% from the year before. Spending on residential construction, which accounted for 43% of the total, rose 0.2% for the month and was 4.2% higher than the year-ago pace. Expenditures on factory construction rose more than 20% from the year before.

Market Closings for the Week

- Nasdaq – 18240, down 279 points or 1.5%

- Standard & Poor’s 500 – 5729, down 79 points or 1.4%

- Dow Jones Industrial – 42052, down 63 points or 0.1%

- 10-year U.S. Treasury Note – 4.36%, up 0.12 point

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast