Money Talk Podcast

Money Talk Podcast, Friday Oct. 18, 2024

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Oct. 14-18, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

No major announcements

Thursday

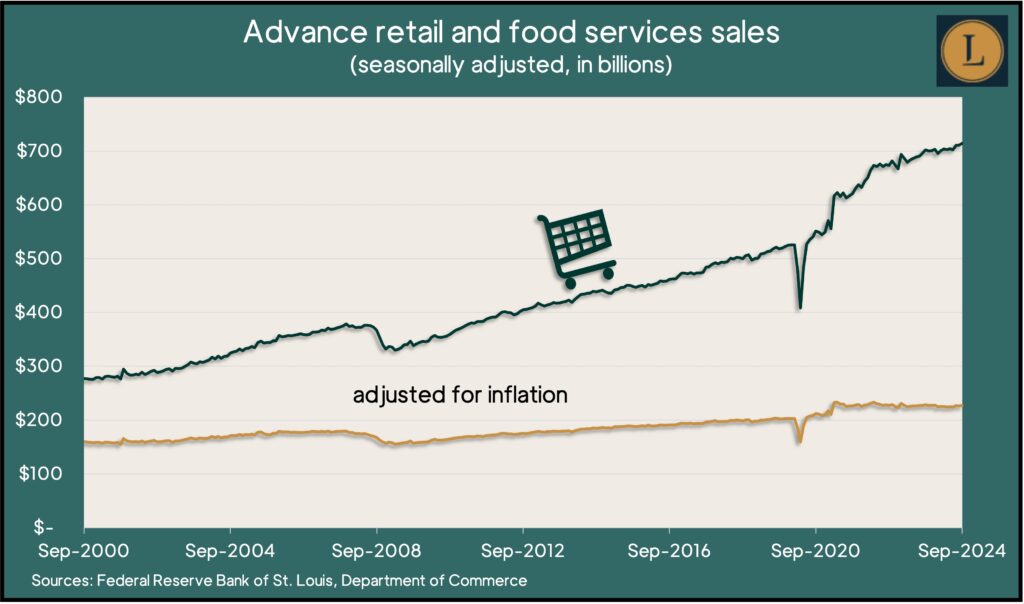

In a further sign of economic resilience, consumers continued spending at stores in September with retail sales advancing 0.4% from August. Sales rose 0.3%, adjusted for inflation. The Commerce Department reported that only three of 13 major categories had sales declines in September: furniture stores, appliance centers and gas stations. Gas station sales continued to fall because of lower prices. Economists watch retail sales as an indicator of consumer spending, which accounts for more than two-thirds of U.S. economic activity.

The four-week moving average for initial unemployment claims rose for the second week in a row, reaching the highest level in two months but staying 35% below the long-term average, dating to 1967. The measure of employers’ reluctance to let workers go continued to indicate a relatively tight labor market. According to Labor Department data, total jobless claims remained at 1.6 million in the latest week, up more than 3% from the year before.

Two hurricanes and a labor strike at Boeing contributed to a setback in U.S. industrial production in September. The Federal Reserve reported that industrial output sank 0.3% from August, including broad declines among durable goods manufacturers. Total output dropped 0.7% from the year before. The same report showed the capacity utilization rate, a measure of potential inflation pressure, fell for the second month in a row and remained below the long-time average for the 22nd month in a row.

Friday

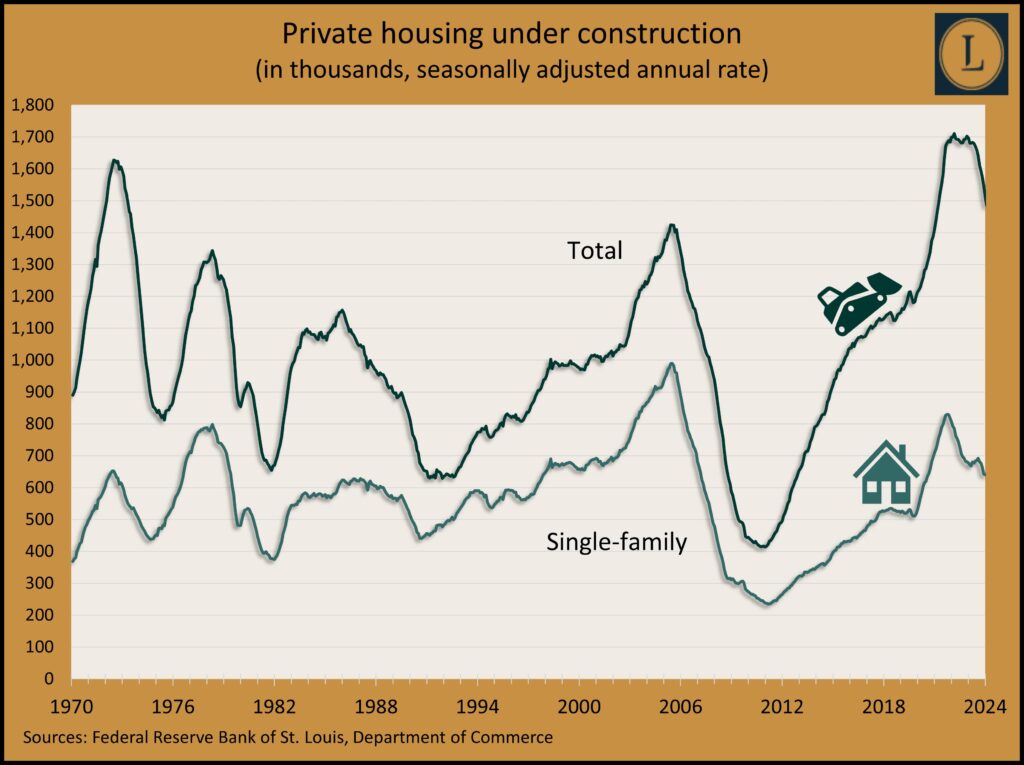

The U.S. housing market continued to weaken in September as the pace for both housing starts and building permits hovered below pre-pandemic levels. Figures from the Commerce Department showed new construction was more than 25% below its pace in mid-2022 peak. The pace of housing permits, an indicator of commitments to future homebuilding, also fell below the level just before COVID, but both permits and starts remained at levels on par with 2007, before the Great Recession. The rate of houses under construction receded to the pace three years ago, which was the fastest in 50 years.

Market Closings for the Week

- Nasdaq – 18490, up 147 points or 0.8%

- Standard & Poor’s 500 – 5865, up 50 points or 0.9%

- Dow Jones Industrial – 43276, up 412 points or 1.0%

- 10-year U.S. Treasury Note – 4.07%, no change

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast