Money Talk Podcast

Money Talk Podcast, Friday Sept. 6, 2024

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Sept. 2-6, 2024)

Significant Economic Indicators & Reports

Monday

Markets and government agencies closed for Labor Day

Tuesday

The manufacturing sector contracted in August for the 21st time in 22 months. The Institute for Supply Management reported that the rate of decline slowed slightly from July, but key components in its index – news orders and production – fell faster. In a statement, the trade group said in part, “Demand continues to be weak, output declined, and inputs stayed accommodative.”

The Commerce Department said construction spending fell 0.3% in July, the first decline since October 2022. Spending on residential construction, accounting for 44% of total expenditures, dipped 0.4% from June, led by single-family housing. Compared to July 2023, total construction spending rose 6.7% while spending on housing rose 7.7%. Manufacturing, representing 11% of all construction spending, was up more than 20% from the year before.

Wednesday

The U.S. trade deficit widened by nearly 8% in July to $78.8 billion – the biggest gap in two years. Exports rose 0.5% from June, led by automotive vehicles, gem diamonds and semiconductors. Imports increased 2.1%, led by computer accessories and non-monetary gold. The Bureau of Economic Analysis reported that through July, the trade gap widened more than 7% from the year before with a 3.7% gain in exports and a 4.5% rise in imports. Trade deficits detract from U.S. economic growth, as measured by the gross domestic product.

Employer demand for workers slowed in July with job openings declining to 7.7 million postings, the lowest since January 2021. As many as 12 million openings were posted in the spring of 2022, according to the Bureau of Labor Statistics. July’s job openings still exceeded the number of unemployed workers looking for work, but it was the narrowest gap between supply and demand in more than three years. In a sign that workers continue to lose confidence in the labor market, the number of workers quitting their jobs to seek other positions stayed below the pre-pandemic level for the eighth month in a row.

The Commerce Department said factory orders rose in July for the first time in five months. The measure of demand for manufactured goods gained 5%, led by sales of commercial aircraft. Through the first seven months of 2024, orders were up 0.4% from the year before. Excluding requests for transportation equipment, orders rose 0.4% from June and were up 1.9% from July 2023. Orders for core capital goods, a proxy for business investments, declined 0.4% for the month and were up 0.5% from the year before.

Thursday

The four-week moving average of initial unemployment claims fell for the fourth week in a row, dropping to 37% below the 57-year average, a sign that employers continue to be relatively reluctant about letting workers go. The Labor Department reported that total claims slipped less than 1% from the week before to just below 1.9 million, which was up 3.5% from the year before.

Worker productivity rose at an annual rate of 2.5% in the second quarter, reflecting a 3.5% uptick in output and a 1% increase in hours worked. The Bureau of Labor Statistics also reported that labor costs rose at an annual rate of 0.4% during the quarter Since the second quarter of 2023, productivity rose 2.7%, and labor costs increased 0.3% – the lowest since 2013. Adjusted for inflation, hourly compensation fell 0.1% in the last year. According to the report, average annual productivity has grown 1.6% since the end of 2019, slightly ahead of the pace during the previous economic cycle, which started in 2007. Since 1947, productivity has averaged 2.1%.

The U.S. service sector expanded in August for the second month in a row at about the same pace as July. The Institute for Supply Management said its survey of purchasing managers showed general optimism for slow growth hampered by pressures from interest rates and concerns about costs. The trade group said the index suggested the U.S. economy was growing at an annual rate of 0.8%.

Friday

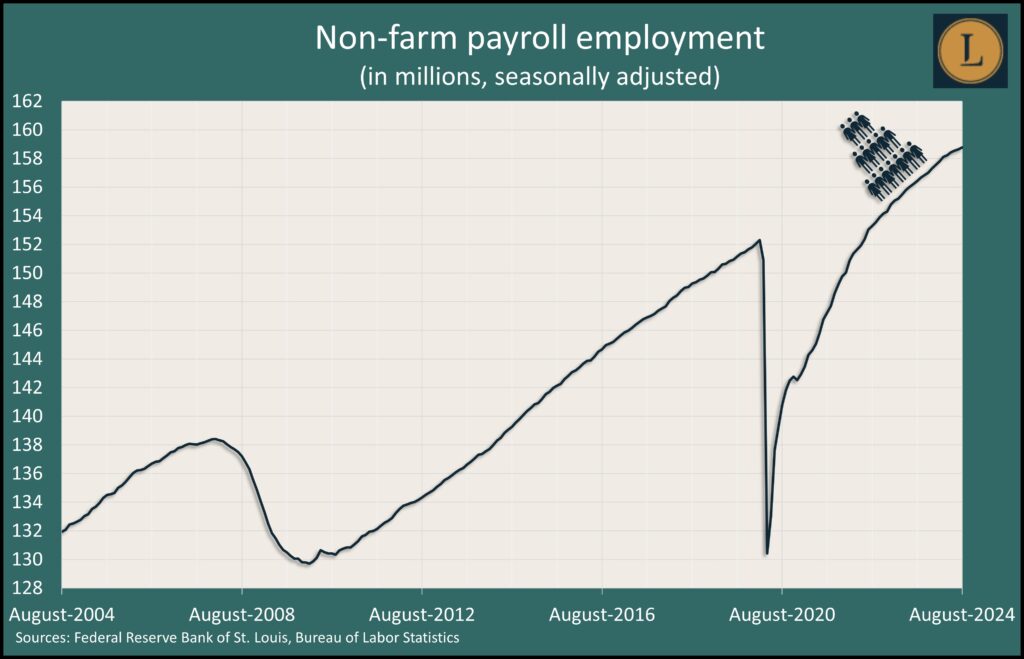

In another sign that the strong labor market may be losing momentum, U.S. employers added jobs in August for the 44th month in a row but at a slower rate. The Bureau of Labor Statistics said payrolls expanded by 142,000 jobs, down 30% from the 12-month pace. The agency also revised June and July job counts downward by 86,000. Hiring of temporary help employees, often an indicator of labor trends, fell to the lowest level since 2020 and was 15% below its peak two years ago. The unemployment rate for August bumped down to 4.2% from 4.3% in July. But a measure of underemployment rose to its highest level in nearly three years.

Market Closings for the Week

- Nasdaq – 16691, down 1023 points or 5.8%

- Standard & Poor’s 500 – 5408, down 240 points or 4.2%

- Dow Jones Industrial – 40345, down 1218 points or 2.9%

- 10-year U.S. Treasury Note – 3.71%, down 0.20 point

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast