The Tom Dupree Show

12-10-22 If You Own Open End mutual Funds...You Could Get an Unexpected Tax Bill

The net asset value formula is a simple metric used to show the intrinsic value of a mutual fund.

You might not care but you should!

After all, when you are investing in a mutual fund some guy is usually telling you what to buy.

Or maybe, you look at the historical performance and just say, “looks good!”

But this one important metric is at least worth looking at when deciding what mutual fund or funds to buy, especially if you are looking at a closed-end fund.

When markets are calm the actual market value should align with the intrinsic value (or net asset value), but guess what…

Sometimes, the market for these funds can get ahead or behind itself.

Once in a while, an opportunity can arise for you to buy at a discount from the fund’s net asset value.

And at Dupree Financial Group, we are all about finding value for our clients.

Using The Net Asset Value Formula of a Mutual Fund

The intrinsic value of a mutual fund’s shares is simple to calculate but it changes every second of the trading day.

The net asset value formula is as follows:

The NAV/share = (Assets – Liabilities)/ (# of shares)

It really is that simple!

To calculate the net asset value of a mutual fund’s shares:

- Add up all of the assets held in the mutual fund.

- From that subtract any and all liabilities.

- Divide that result by the total number of shares in the mutual fund.

That result is the actual per share intrinsic value of the fund. It doesn’t matter whether it’s a closed end fund or an ETF or any other instrument you can imagine. Once you have made this calculation, you have found what the fund should probably be worth on the open market.

Where to Find Mutual Fund Net Asset Values

If you looked up every single holding and were constantly updated on any liabilities, you could calculate the value by hand.

Luckily for us, we don’t have to do this.

Mutual Funds are required to report their NAV at the end of each trading day. As established in the Investment Company Act of 1940, any changes must be reported no later than the first calculation the following trading day whether it be from redemptions or otherwise. The NAV can be estimated throughout the trading day, but at the end of the day it is required to be updated.

Open-Ended Funds

Open-ended funds trade at the net asset value as calculated at that end of day. There is no discount to be had with respect to NAV in these open-ended funds. When additional capital comes into these funds, they are purchased at net asset value and additional shares are issued.

At the end of 2021, there were 32,930 such open-ended funds the plurality of which are equity funds. Interestingly, there are only 2,578 companies publicly traded on the NYSE and an additional 3,788 listed on the NASDAQ.

The NAV of these funds can easily be found online on sites like Yahoo Finance. Simply go to the site and enter the ticker symbol of the fund in the quote screen. From there go to historical prices and you will see the NAV from the previous close.

Closed-End Funds

Closed-End Funds are a different kettle of fish. With these types of funds, a set number of shares are issued at the origination of the fund. And the shares change in value throughout the trading day. The market sets the price for these 460 such funds throughout the trading day.

The market price can trade at a discount or even a premium to the actual net asset value of the fund.

Often there is a reason for this discount so… buyer beware!

- There can be governance issues that make individual investors leery.

- The fund’s reputation might not be up to par.

- The assets in the fund might be highly leveraged.

- It is possible that there are recent changes in the distribution policy.

Sometimes, however, the baby is actually thrown out with the bathwater. And these funds might present an opportunity. It is possible that the fund is trading at a discount to its intrinsic value for no other reason than that the asset classes the fund invests in are just out of favor.

That is why you should care about the net asset value formula!

Oftentimes, understanding this can prevent you from paying too much for a fund which is certainly valuable.

Other times, you might find a diamond in the rough. There are firms that specialize in actually buying these closed-end funds when they are trading at such a discount. Then they just wait for the discount to close before exiting. These firms can also utilize a mechanism called closed-end fund arbitrage to accomplish the same task.

What Causes a Reduction in Net Asset Value

The NAV of a mutual fund can decrease for many reasons.

Again, the formula used to calculate the NAV is as follows:

(Assets-Liabilities)/ (# of shares outstanding) = Net Asset Value

All other things being equal, when the assets decrease the NAV will also decrease in lockstep.

So, whatever causes the asset value to decrease on a per share basis will cause the NAV to decrease as well.

Asset Impairment

In 2022, one obvious reason that the NAV might decrease is because the equities continuously held by the fund have decreased in value. As the market has fallen so too have the assets still held by most mutual funds.

Another big reason that the assets of a fund could decrease is due to distributions made to you as the fund owner.

Dividend Distributions

Just as if you owned direct shares in a company, the mutual fund earns dividends on its holdings throughout the year. Periodically, the fund will distribute these dividends to you and all of its owners. You will likely have the option to use these distributions to purchase additional shares in the fund or receive the dividend in cash.

When these dividend distributions are paid, they will decrease the fund’s assets by an equal amount. This summarily decreases the NAV per share by the same amount as this payout.

These dividend distributions are typically either distributed quarterly or annually.

Capital Gains Distributions

When the mutual fund you own sells an equity holding, you should receive a capital gains distribution. This distribution is equivalent to your percentage of the proceeds from the sale of said asset.

And, similar to the dividend distributions, the NAV of your fund will be reduced by the same amount of this distribution.

Example:

Let’s suppose you own 5000 shares of a specific fund that currently has a net asset value of $10/share. The total value of your holding would therefore be $50,000.

The fund realizes a capital gains distribution equal to 10% of its NAV. That means it would be required to distribute $1.00 per share to you. You could either allow the fund to reinvest that $5,000 ($1.00 per share x 5000 shares), or you could receive this distribution in the form of cash.

When the fund makes this distribution, the NAV of the fund would be reduced to $9.00/share as a result. Furthermore, the value of your original position is reduced to $45,000 from the pre-distribution value of $50,000.

If you reinvested the $5,000 you would actually just be purchasing an additional $5,000 worth of shares, approximately 555.55 shares. In that case, your position would change from 5000 shares at $10.00 per share to 5555.55 shares at a share price of $9.00.

In either case, the total value of your holding would still equal $50,000.

Taxable Gain in a Down Year

2022, has been a less than stellar year for shareholders. But, even in a down year like this one, you might have an ugly surprise waiting in your mailbox next February.

Wanna guess what happens if you own a mutual fund that is not held in a tax-sheltered account?

The tax man cometh and taketh away.

By next February 15th, your fund is required to mail you a 1099-DIV statement. Among other things, the 1099-DIV statement includes dividends you earned from the fund as well as any capital gains distributions you might receive in December.

Tax Treatment of Dividends

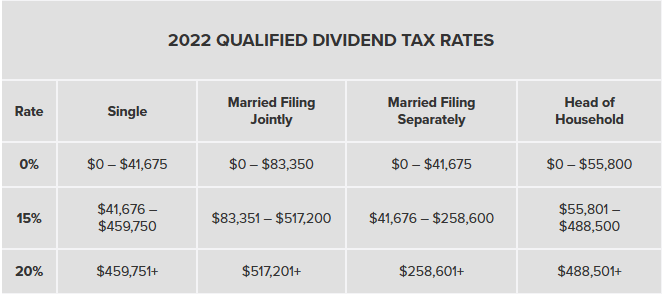

For the 2022 tax year, the following table shows the tax rate on qualified dividends:

You could owe up to 20% of your dividend distributions from mutual funds to the IRS. If you are not new to investing, you are likely used to this form of taxation.

But what about the capital gains this year?

Tax Treatment of Capital Gains

In addition to the dividend distribution, you could very well be hit with capital gains even in 2022. With stocks falling in value this year, you might be surprised to get hit with this tax burden.

But you very well could!

If you purchased a mutual fund in the beginning of 2022, those funds were likely sitting on equity holdings that were already way up from when they were originally purchased. These so-called “embedded gains” already existed at the time you purchased the fund. Now that the fund sold these holding this year, you could very likely be hit with a taxable event.

Talk about a double whammy!

The value of your fund decreased this year, and now this!

If the capital gain is long-term (held longer than a year), you could owe up to 20% of that distribution to good ole’ IRS. If the gain is short term, however, it is taxed as ordinary income and that could be as high as 37%.

The key takeaway is this!

When you buy a mutual fund, you do not know your cost basis on the individual shares of stock held in the fund. And, as a result, you can be hit with an unforeseen capital gain. When you invest in a mutual fund scheme, you might be unwittingly inheriting a tax obligation… yuck!

I don’t know about you, but I don’t like taxes!

Check With Dupree Financial Group Before You Invest

There is a better path for your future!

If instead of buying mutual funds at the beginning of 2022, you could have bought individual shares of the companies that will help you meet your needs for the long term.

By purchasing individual companies, you will have no “embedded gains”. Your cost basis on your individual holdings is known at the time of your initial investment.

And only at the time you decide to sell the investment would you be subject to capital gains taxes, if you are subject to them at all. You will also have the flexibility to more efficiently manage your tax liability.

If you desire ultimate flexibility and a clear understanding of your overall strategy, you need a company like Dupree Financial Group, LLC working for you.

So…

Before you decide to take the leap on one of a multitude of funds, you should sit down with a trusted financial advisor.

At Dupree Financial Group, LLC, we do the work for you. We have been in the business of building wealth for our clients for generations. And we can do it for you today.

Research is at the heart of everything we do as a company. We are a disciplined value-oriented firm. We have found so many opportunities in the current climate. And it is these opportunities that could help you build wealth in the years to come.

Schedule a meeting with us today for a no-obligation look at your portfolio. It is always a good time to get a second set of eyes on your portfolio. Or just give us a quick call at 859-233-0400.

The post The Net Asset Value Formula and Why You Should Care! appeared first on Dupree Financial.

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast