Not Your Average Financial Podcast™

Episode 346: When Bank on Yourself® Policy Loans Matter Most

In this episode, we ask:

- Why haven’t you subscribed yet?

- What big purchases are coming up?

- Can you earn your way out of expenses?

- What happens in retirement?

- Can you earn your way out of expenses throughout all of the ages of life?

- What’s the difference between earning income at age 35 and age 86?

- What allows for uninterrupted compounding?

- How is this possible?

- Who offers non-direct recognition policy loans?

- How about an example?

- What is the amount of the cash value?

- What is the simple interest rate on the policy loan?

- What happens over four years?

- What happens to the policy?

- What is the gain?

- Did you earn more than you spent?

- What happens over a longer time horizon?

- What about dividends?

- Would you like to hear Episode 345?

- Would you like us to review your policy?

- What is unbelievably cool?

- What products stop growing your money when you spend it?

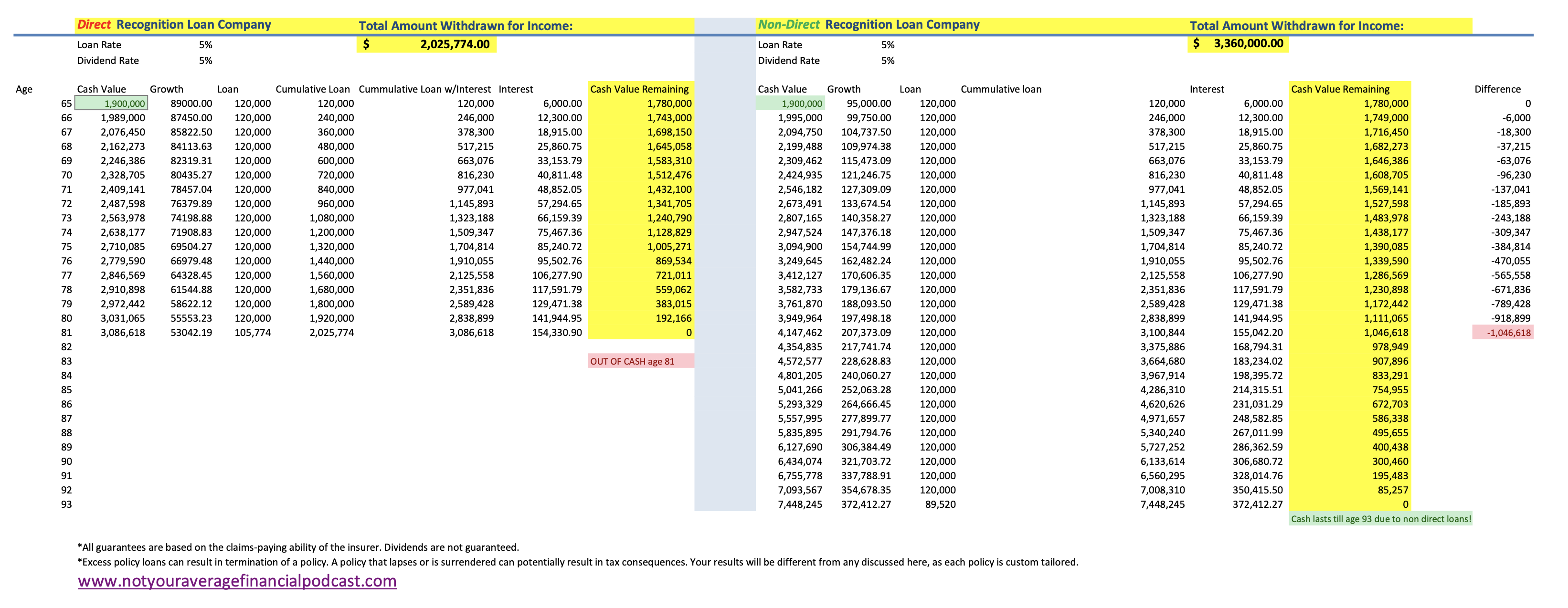

- Can you imagine this chart?

- What happens on the spend down?

- What continues to earn interest?

- What if you could continue to maintain the compounding growth on your money?

- What are the implications?

- What results shocked Mark?

- What if they never paid off the loan?

- How about another apples-to-apples example?

- What does a policy loan look like in a direct recognition policy?

- What about the interest?

- What about receiving a weird letter from the insurer at age 81?

- Where was the compounding?

- Where did the growth go?

- What does a policy loan look like in a non-direct recognition policy?

- What about the interest?

- What is the difference?

- What is the policy growth based upon?

- What about compounding and accumulation?

- What about loan interest?

- How much more?

- Is the policy designed the right way?

- Who is getting penalized?

- How about a timely warning?

- Does your agent understand the working parts well?

- Is your policy built correctly?

- Is your policy breaking compound growth?

- What about the Gold Standard of the Bank on Yourself® Professional training?

- What would it look like?

- What about absolute certainty?

- Do you have to know everything about how your phone was engineered to enjoy it?

- How is a Bank on Yourself® type whole life insurance policy like a smart phone?

- When was the last time you reviewed your current policy?

- Would you like a second set of eyes?

- Would you like to learn more by listening through our Episodes in a List?

- What about time?

- Are you serious?

- Would you like a meeting with me or an associate?

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast