Insureblocks

Ep. 177 – Why decentralised finance matters and the policy implications? – OECD Report

Iota Nassr is a policy analyst at the OECD within the financial markets division. She currently manages the FinTech experts group of the OECD Committee on Financial Markets, leading the analysis around anything that has to do with digitalization of finance. The OECD Report “Why decentralised finance matters and the policy implications” is product of the committee’s expert group composed of representatives of the 38 OECD members coming from Central Banks, Ministry of Finance and other financial authorities.

What is blockchain?

Iota’s definition of blockchain hasn’t changed much since her previous podcast on Insureblocks on “Tokenisation of Assets and Potential Implications for Financial Markets – OECD Report” on the 13th of June 2021. She still sees blockchain and DLT, more broadly, as a way to record, share information and to exchange value in a decentralised manner without the need for trusted central authorities or intermediaries.

However now she believes the emphasis is now more on the programmable nature of decentralised distributed ledger technologies and the level of disintermediation involved in the different networks and structures that we observe in the market.

Why this report?

The Summer of 2020, also known as the DeFi summer caught the attention of the OECD. This was due to the exponential growth they were observing and the level of participation of retail investors in what is a very highly volatile market that is devoid of the traditional safeguards that are in place for investors and consumers in traditional financial markets.

The feedback loops they have observed between DeFi and mainstream crypto such as Bitcoin, Ether ,the main stable coins along with the recycling of profits between the two kinds of environments, made it increasingly critical for the OECD to have a look at this space.

The final reason for analysing this market was the growing institutionalisation of crypto assets, which may be increasing risks of interconnectedness between decentralised and traditional finance. This report’s objectives is to like into DeFi models to understand the risks, opportunities and implications for traditional finance.

What is Defi?

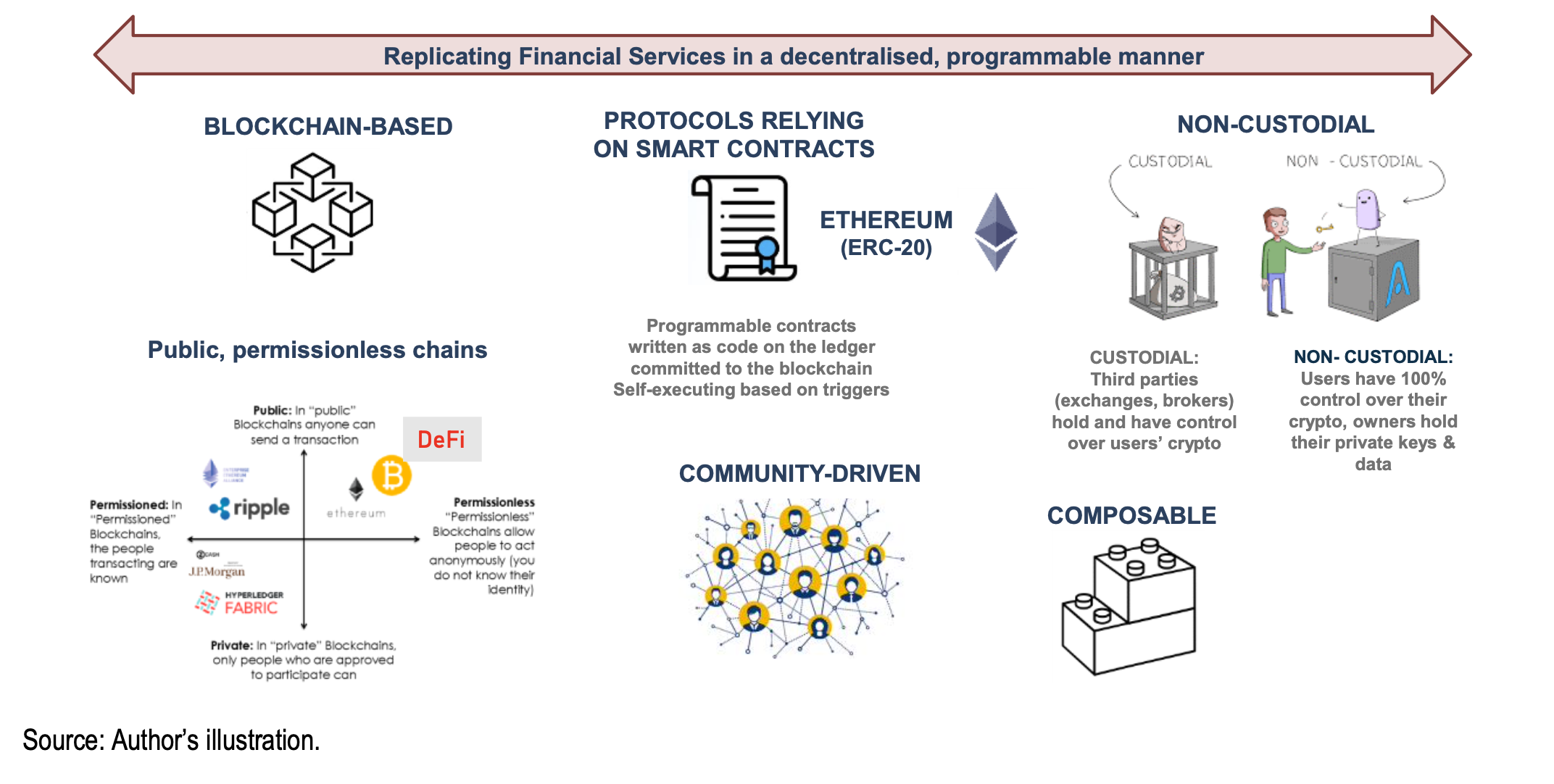

DeFi, decentralised finance, claims to replicate what is known as traditional finance in a decentralised way in an open way through applications built on Ethereum and increasingly on other blockchains.

There are two possible misconceptions around DeFi. The first is that not all DLT based financial applications are DeFi. So the fact that a financial application is built on the blockchain does not make it by default part of DeFi. The second misconception has to do with self proclaimed DeFi applications that may not be truly decentralised. The degree of decentralisation varies from one project to another.

The report defines three key defining features:

- Non-custodial: The protocols and the applications have a non-custodial nature. There is no central authority or other intermediary gains access to or control over participants’ digital assets; instead, participants manage their private keys, and therefore their digital assets, directly.

- Self-governed and community-driven: Most DeFi protocols are open-source and allow the community to review and further develop the code underlying the protocols. This happens through the use of governance tokens.

- Composable: Existing components of DeFi networks (i.e. digital assets, smart contracts, protocols and applications built on top of the protocol layer) can be combined to create new applications. The open source nature of DeFi applications is a critical enabler of this attribute, as it allows everyone to look at the code and use it to create new applications.

Source: OECD Report Author

Most popular DeFi products

The concept of liquidity mining and of collateralized lending on the DeFi lending protocols was one of the most obvious ways for investors to earn yield on the back of mainstream crypto that they already held. Because of that collateralised lending rapidly became the fastest growing DeFi product followed by decentralised exchanges (DEX) while other applications such as derivates and synthetics also grew in popularity.

Institutional investors alongside decentralised exchanges are also participating in collateralized lending.

Growing interconnectedness between crypto and traditional markets

The OECD Committee on Financial Markets has noticed a shift in traditional financial institutions from the education phase of what is Bitcoin and what is blockchain to the investment phase where they are allocating parts of their portfolio in such assets. The Committee is looking at the potential risk of growing interconnectedness between decentralised and traditional finance which could lead to the potential spill over to the traditional financial system and the real economy.

Iota gives an example that if there was a generalised distress in the crypto market, an investor who is exposed to losses on his crypto related investments may have to close his positions on other parts of his portfolio therefore propagating this kind of shock.

KYC & AML

this is a bit of a paradox because we know that the blockchain allows for complete transparency. And all transactions are traceable and verifiable on the chain. But they are verifiable and traceable in pseudonymous way, we don’t have recourse to the identity of the participating node. And this is what makes it complicated.

Unlimited leveraged trading of crypto-assets

The possibility to engage in almost unlimited leveraged trading of crypto-assets is one of the main risks involved in DeFi. Whilst current DeFi applications benefit from high levels of over-collateralisation, it could be expected that further growth of the Defi market would bring it that level down to allow for better capital efficiency, as competition would put pressure on tokenomics involved in DeFi protocols. The volatility of crypto-asset prices intensifies the fragility of the DeFi market, and volatility spikes in the price of main crypto-assets pledged as collateral for borrowing and leverage or provided as liquidity for yield farming can induce massive automatic liquidations in DeFi protocols. Such liquidations can have a domino effect on investor holdings across the board, and may even have spill over effects in traditional financial markets.

Positives that DeFi applications can provide to financial markets

DeFi applications have the potential to provide benefits to financial market participants in terms of speed of execution and transaction costs, driven by the efficiencies produced by DLT-technological innovation and disintermediation of third parties replaced by software code of smart contracts.

The governance arrangements along with the open source nature of DeFi allow for possibly more equitable participation of users and the promotion of innovation in financial services.

Drivers of institutional investors in digital assets

The OECD has identified three forces that underline and contribute to this increased institutional investor interest in digital assets of which the majority is in Bitcoin, followed by Ether.

The first force has to do with this search for yield in what was until recently a prolonged low interest rate environment. The same kind of speculative forces, the same kind of fear of missing out that led retail investors has been driving also institutions.

The second reason is the potential of crypto assets for diversification and portfolio optimization. Investors perceive as uncorrelated nature of returns, they wish to diversify their portfolio by adding this kind of non-correlated assets such as crypto. However, the OECD’s report dismisses this hypothesis as they have been seeing a growing correlation between mainstream crypto assets and the large traditional asset class.

The third reason is the perceived benefit of crypto for institutional investors as an inflation hedge. However, the OECD’s analysis finds that the main crypto assets have not really performed as effective inflation hedge, but that does not prevent investors from perceiving it as a good inflation hedge which drives them demand for Bitcoin in particular

How can existing regulatory frameworks work with decentralised structures?

Some of the tools that are being used in centralised settings may need to be redesigned in order to be interoperable and compatible with decentralised structures.

One other approach is to re-centralise DeFi in order to get some kind of comfort from a supervisory and regulatory standpoint without necessarily completely undermining decentralisation. Some forms of centralization already exists in such networks and could be considered as this single regulatory access point. For example DAOs could play this role or majority governance token holders.

Other tools could be around regulatory compliance embedded in code, allowing and or demanding the audit of smart contracts, having mandatory reporting in an automated fashion through machine readable formats.

Roles policy makers can have in DeFi

The report lists a number of roles policy makers can provide:

- Financial education

- Improved disclosures in DeFi applications can be seen as a first easy step towards greater protection of participants. For example disclosures on whether or not someone holds an admin key and what kind of rights it gives its holder.

- Increased regulatory clarity

- Identify new rules if policy gaps are found and identified.

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast