Christian Financial Perspectives

100 – The History of Economic Booms and Busts

The History of Economic Booms and Busts

Welcome to our 100th podcast on economic booms and busts.

Welcome to our 100th podcast!!! We’ve taken quite a long break from recording over the summer, but we are back at it with Christian Financial Perspectives Podcast. In this episode, Bob and Shawn discuss the history of economic booms and busts, from the rise of the Roman Empire all the way up to the recent 2008 Real Estate Bubble that Burst and where we are today. HISTORY repeats itself over and over with nearly the exact same mistakes. Will it be any different this time? Listen to find out!

With this being our 100th Podcast, we also reflected on the top 10 up to this point:

10) Episode 66 – 20 Money Principles for 2020

9) Episode 79 – Creating a Family Legacy

8) Episode 05 – The 10 Uses of Money

7) Episode 74 – Dealing With Fear and Uncertainty During Covid-19

6) Episode 92- 21 Financial Scriptures to Live By in 2021

5) Episode 78 – Husband/Wife Communication With Finances

4) Episode 82 – Are Rental Homes A Good Investment

3) Episode 83 – The Life Stages of Financial Planning

2) Episode 1 – What God’s Word Says About Money

1) Episode 80 – 7 Keys to Significance and Finishing Well

HOSTED BY: Bob Barber, CWS®, CKA®

CO-HOST: Shawn Peters

Mentioned In This Episode

Christian Financial Advisors

.dt-shortcode-soc-icons.soc-icons-6d3d70cdad80c3022dac88b2b035272f a {

margin-right: 4px;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f {

min-width: ;

min-height: ;

font-size: ;

border-radius: ;

margin-right: 4px;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:before,

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:after {

min-width: ;

min-height: ;

padding: inherit;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f.dt-icon-border-on:before {

border: solid ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f.dt-icon-hover-border-on:after {

border: solid ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:hover {

font-size: ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f .soc-font-icon,

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f .soc-icon {

font-size: ;

}

.dt-shortcode-soc-icons.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14 a {

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14 {

min-width: 26px;

min-height: 26px;

font-size: 16px;

border-radius: 100px;

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:before,

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:after {

min-width: 26px;

min-height: 26px;

padding: inherit;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14.dt-icon-bg-on:before,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14.dt-icon-bg-on:before {

background: #7ac9ab;

}

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14.dt-icon-border-on:before {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14.dt-icon-hover-border-on:after {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:hover {

font-size: 16px;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:hover .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:hover .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:hover .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:hover .soc-icon {

color: rgba(255,255,255,0.75);

background: none;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14.dt-icon-hover-bg-on:after,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14.dt-icon-hover-bg-on:after {

background: #014a8f;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:not(:hover) .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:not(:hover) .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:not(:hover) .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14:not(:hover) .soc-icon {

color: #ffffff;

background: none;

}

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14 .soc-font-icon,

.dt-shortcode-soc-icons a.single-soc-icon-d68b92c42c4cb64f2c1eb98edd27cc14 .soc-icon {

font-size: 16px;

}

Website.dt-shortcode-soc-icons.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20 a {

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20 {

min-width: 26px;

min-height: 26px;

font-size: 16px;

border-radius: 100px;

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:before,

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:after {

min-width: 26px;

min-height: 26px;

padding: inherit;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20.dt-icon-bg-on:before,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20.dt-icon-bg-on:before {

background: #7ac9ab;

}

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20.dt-icon-border-on:before {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20.dt-icon-hover-border-on:after {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:hover {

font-size: 16px;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:hover .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:hover .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:hover .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:hover .soc-icon {

color: rgba(255,255,255,0.75);

background: none;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20.dt-icon-hover-bg-on:after,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20.dt-icon-hover-bg-on:after {

background: #014a8f;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:not(:hover) .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:not(:hover) .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:not(:hover) .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20:not(:hover) .soc-icon {

color: #ffffff;

background: none;

}

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20 .soc-font-icon,

.dt-shortcode-soc-icons a.single-soc-icon-8b26b2315cc09a22fb5e932567ea5b20 .soc-icon {

font-size: 16px;

}

.dt-shortcode-soc-icons.single-soc-icon-6299eb3e1ed903acf2ad372a92129613 a {

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613 {

min-width: 26px;

min-height: 26px;

font-size: 16px;

border-radius: 100px;

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:before,

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:after {

min-width: 26px;

min-height: 26px;

padding: inherit;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613.dt-icon-bg-on:before,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613.dt-icon-bg-on:before {

background: #7ac9ab;

}

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613.dt-icon-border-on:before {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613.dt-icon-hover-border-on:after {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:hover {

font-size: 16px;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:hover .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:hover .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:hover .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:hover .soc-icon {

color: rgba(255,255,255,0.75);

background: none;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613.dt-icon-hover-bg-on:after,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613.dt-icon-hover-bg-on:after {

background: #014a8f;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:not(:hover) .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:not(:hover) .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:not(:hover) .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613:not(:hover) .soc-icon {

color: #ffffff;

background: none;

}

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613 .soc-font-icon,

.dt-shortcode-soc-icons a.single-soc-icon-6299eb3e1ed903acf2ad372a92129613 .soc-icon {

font-size: 16px;

}

.dt-shortcode-soc-icons.single-soc-icon-673604afb00ebbf1e036c2d6415c7456 a {

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456 {

min-width: 26px;

min-height: 26px;

font-size: 16px;

border-radius: 100px;

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:before,

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:after {

min-width: 26px;

min-height: 26px;

padding: inherit;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456.dt-icon-bg-on:before,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456.dt-icon-bg-on:before {

background: #7ac9ab;

}

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456.dt-icon-border-on:before {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456.dt-icon-hover-border-on:after {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:hover {

font-size: 16px;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:hover .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:hover .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:hover .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:hover .soc-icon {

color: rgba(255,255,255,0.75);

background: none;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456.dt-icon-hover-bg-on:after,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456.dt-icon-hover-bg-on:after {

background: #014a8f;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:not(:hover) .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:not(:hover) .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:not(:hover) .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456:not(:hover) .soc-icon {

color: #ffffff;

background: none;

}

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456 .soc-font-icon,

.dt-shortcode-soc-icons a.single-soc-icon-673604afb00ebbf1e036c2d6415c7456 .soc-icon {

font-size: 16px;

}

Bob Barber, CWS®, CKA®

.dt-shortcode-soc-icons.soc-icons-6d3d70cdad80c3022dac88b2b035272f a {

margin-right: 4px;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f {

min-width: ;

min-height: ;

font-size: ;

border-radius: ;

margin-right: 4px;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:before,

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:after {

min-width: ;

min-height: ;

padding: inherit;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f.dt-icon-border-on:before {

border: solid ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f.dt-icon-hover-border-on:after {

border: solid ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:hover {

font-size: ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f .soc-font-icon,

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f .soc-icon {

font-size: ;

}

.dt-shortcode-soc-icons.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e a {

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e {

min-width: 26px;

min-height: 26px;

font-size: 16px;

border-radius: 100px;

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:before,

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:after {

min-width: 26px;

min-height: 26px;

padding: inherit;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e.dt-icon-bg-on:before,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e.dt-icon-bg-on:before {

background: #7ac9ab;

}

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e.dt-icon-border-on:before {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e.dt-icon-hover-border-on:after {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:hover {

font-size: 16px;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:hover .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:hover .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:hover .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:hover .soc-icon {

color: rgba(255,255,255,0.75);

background: none;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e.dt-icon-hover-bg-on:after,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e.dt-icon-hover-bg-on:after {

background: #014a8f;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:not(:hover) .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:not(:hover) .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:not(:hover) .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e:not(:hover) .soc-icon {

color: #ffffff;

background: none;

}

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e .soc-font-icon,

.dt-shortcode-soc-icons a.single-soc-icon-9da66a1b85bf7d7b0bed9156157b4f4e .soc-icon {

font-size: 16px;

}

Shawn Peters

.dt-shortcode-soc-icons.soc-icons-6d3d70cdad80c3022dac88b2b035272f a {

margin-right: 4px;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f {

min-width: ;

min-height: ;

font-size: ;

border-radius: ;

margin-right: 4px;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:before,

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:after {

min-width: ;

min-height: ;

padding: inherit;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f.dt-icon-border-on:before {

border: solid ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f.dt-icon-hover-border-on:after {

border: solid ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f:hover {

font-size: ;

}

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f .soc-font-icon,

.dt-shortcode-soc-icons a.soc-icons-6d3d70cdad80c3022dac88b2b035272f .soc-icon {

font-size: ;

}

.dt-shortcode-soc-icons.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f a {

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f {

min-width: 26px;

min-height: 26px;

font-size: 16px;

border-radius: 100px;

margin-right: ;

}

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:last-child {

margin-right: 0;

}

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:before,

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:after {

min-width: 26px;

min-height: 26px;

padding: inherit;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f.dt-icon-bg-on:before,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f.dt-icon-bg-on:before {

background: #7ac9ab;

}

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f.dt-icon-border-on:before {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f.dt-icon-hover-border-on:after {

border: 0px solid ;

}

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:hover {

font-size: 16px;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:hover .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:hover .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:hover .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:hover .soc-icon {

color: rgba(255,255,255,0.75);

background: none;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f.dt-icon-hover-bg-on:after,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f.dt-icon-hover-bg-on:after {

background: #014a8f;

}

#page .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:not(:hover) .soc-font-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:not(:hover) .soc-font-icon,

#page .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:not(:hover) .soc-icon,

#phantom .dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f:not(:hover) .soc-icon {

color: #ffffff;

background: none;

}

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f .soc-font-icon,

.dt-shortcode-soc-icons a.single-soc-icon-5f15fdc18e898f69ca188fd0434de05f .soc-icon {

font-size: 16px;

}

Want to ask a question about your specific situation? Schedule a complimentary 15 minute phone call.

SCHEDULE AN APPOINTMENTDid you enjoy this episode? Sign up for email updates and never miss an episode.

EPISODE TRANSCRIPT

[INTRODUCTION]

Welcome to “Christian Financial Perspectives”, where you’re invited to gain insight, wisdom and knowledge about how Christians integrate their faith, life and finances with a Biblical Worldview. Here’s your host Christian Investment Advisor, Financial Planner, and Coach, Bob Barber.

[EPISODE]

Bob:

Welcome, everyone. Welcome to the 100th Christian Financial Perspectives podcast. I finally made it, Shawn. 100. I can’t believe that. There’s a lot of work in those first 99 podcasts, a whole lot of work, hours and hours. And I realize that I’m going to get back in the saddle again. And I apologize to all my podcasts listeners. I know we’ve pretty much been off all summer, but as I was building the podcast, this one that we’re going to be doing today, Shawn, I didn’t realize how many hours I put into these things – for this 30 or 40 minutes. It’s like 10 hours that goes into that. So I’m going to have to get back in that mode again, it’s kind of like an artist painting a brand new piece of art on a piece of canvas and you’ve got to get into that mindset of creating. Make sense?

Shawn:

It makes sense. We’re just going to jump back on that bike. I’m sure we’ll get the balance back, figure out the steering, hopefully only crash a couple of times, but we’ll get there.

Bob:

And I’m excited, now hopefully in a couple of years, we’ll be saying welcome to our 200th podcast, but we had so many good ones in the first 99. And during this time, Mary Jo Lyons started with me and then she retired, and I know her and Mike are having a great retirement down in Rockport, and Bailey came in and helped me for a while. And I miss her. She did a great job on the podcast, but things always get better. So I’m looking forward to you doing this with me, but in those first 99 podcasts, there were some really good ones in there.

Shawn:

There were. So Jenna went through and came up with our top 10 podcasts based on number of downloads and watches. So if anyone wants to be able to go back and listen to them, I’m going to be listing them here for you. We’re also going to post this list on our website for the podcast, christianfinancialpodcast.com. So here they are in no particular order though, podcast number 66, which is our 20 money principles for 2020. I think it still applies for other years as well.

Bob:

Yeah, by the way, this is in the order of the most listened to is what Jenna told me.

Shawn:

Yeah. Well just kidding then. So the next one, podcast number 79, creating a family legacy; podcast number 5 oldie, but a goodie, the 10 uses of money; podcast number 74, dealing with fear and uncertainty during COVID-19, which I do think would be very applicable for any time there’s something going on, whether it’s COVID-19 or not. Podcast number 21, financial scriptures to live by; podcast number 78, husband and wife communication with finances. That’s a good one. Podcast number 82, are rental homes a good investment.

Bob:

I thought that was going to be our number one podcast. But when she looked at the downloads, it wasn’t. It was in the top 10.

Shawn:

Almost made top three.

Bob:

A lot of good information in there. I think my realtors really loved that one, are rental homes a good investment, because it’s really not.

Shawn:

Hey, we didn’t say real estate in general, you’re really mostly talking about rental homes. There’s a lot of variation in real estate as an investment.

Bob:

I remember getting into all the cost of owning a rental home and that’s after all the taxes, insurance, maintenance.

Shawn:

We might have to circle back on that one. I think you’ve had a little bit of personal experience on how fun.

Bob:

Yeah. Yeah I have. But anyway, I’m kind of a glutton for punishment when it comes to vacation homes. So I don’t have one right now though.

Shawn:

All right. Well, our top three, if you will, podcast number 83, the life stages of financial planning; podcast number one, what God’s word says about money. It’s always nice to see your first one is still in the top three.

Bob:

I think that’s because Christians want to know what God’s word says about money and they don’t realize there’s over 2000 scriptures that talk about stewardship and how to handle it. So there’s a few scriptures. Now, we don’t cover all 2000 in that one. We cover like the top 50. Yeah.

Shawn:

That’s good. Good to know. So you guys don’t have to go through all 2000. All right. And then our number one, as of this recording, podcast number 87, 7 keys to significance and finishing well.

Bob:

So there you go. Those are our top 10 podcasts. And so Shawn, it’s time to start the 100th podcast.

Shawn:

Let’s try to make this one in the top 10, Bob.

Bob:

I think it will be because it has so much to do with where we are now, but where you are now, you’ve got to look back. So today is going to be a history lesson on economic booms and bust. Does that make sense? So things that rise and things that go back down, and I think this is very timely for all the different markets that we’re seeing right now and what is happening, especially in real estate. Our listeners are all over the nation, but Rachael was telling me the other day she was reading an article up in Idaho where real estate prices have risen something like 70% or 80% in the last year. Yeah.

Shawn:

I think it was Idaho

Bob:

But anyway, yeah, it’s crazy.

Shawn:

It wasn’t necessarily the state you would think as having a huge boom.

Bob:

But again, it’s California. I don’t know that they must’ve piled everybody up in California though. Now they’re moving back.

Shawn:

Well, not even just California, but a lot of states have been seeing influxes of people. And I think a big part of it, as you can look at it as positive or negative, depending on which side of it you are, but with COVID and the pandemic, then more and more people working from home. And so that’s basically opened it up for if you have a job that is still going to be work from home as an option, then it kind of opens up where you live. You don’t necessarily have to live within driving distance to the office.

Bob:

You can live wherever you want to. Yeah.

Shawn:

You just gotta have good internet.

Bob:

But gosh, we’ve had such a boom in real estate. And of course stocks, the same thing. And it just seems like all the different asset classes are becoming overinflated, meaning that we could be approaching a bubble. I’m not saying we’re in one, but we could be, and boy when they burst, it’s not a pretty picture. But Shawn, I know there’s a scripture I love. And I’m going to have you go over this with us that really has to do with booms and busts and it’s not always going to be bad. It’s not always going to be good. We’re going to go back and forth.

Shawn:

Yeah. It was one of my favorite passages, actually. There’s a time for everything. So this is Ecclesiastes 3:1-7. “There is a time for everything and a season for every activity under the heavens, a time to be born and a time to die, a time to plant and a time to uproot, a time to kill and a time to heal, a time to tear down and a time to build, a time to weep and a time to laugh, a time to mourn and a time to dance, a time to scatter stones and a time to gather them, a time to embrace and a time to refrain from embracing, a time to search and a time to give up, a time to keep and a time to throw away, a time to tear and a time to mend, a time to be silent and a time to speak.”

Bob:

And a time for this scripture right now to be over. What’s so interesting is I was using this exact same scripture last year when everything was down so much, and now everything is up so much. It’s another good scripture to go back and look at it because life is so full of ups and downs, and nothing is going to continue to go straight up without eventually taking a breather and resetting just like when it’s down, you got to look up, but when you’re way up on the peak, you kind of need to look down and say, okay, how high have I gotten up? Am I getting in a danger zone?

Shawn:

And even if we’re not in a bubble, a true bubble that might burst, the thing that you can see looking back in history and looking back at the prices, not just in the stock market, but in many asset classes, is that there are normal market cycles. So if you hear someone say, well, there’s no way it’s going to go down and things are going to continue to go up. It just shows a clear misunderstanding of how markets actually work. There are always periods of growth, periods of pullback. Sometimes, which we’re going to be documenting in this podcast. But sometimes, you have a lot of unsupported growth and depending on the situation, that’s what can really turn into a true bubble and a bust.

Bob:

I know you have a favorite saying I hear you say around here about history.

Shawn:

Yeah. The old saying that those that do not learn from history are doomed to repeat it. But from my experience, it seems a more accurate phrase might be for us is what we learned from history is that most people do not learn from history.

Bob:

So they think it’s different this time, right? Yeah.

Shawn:

Everybody, well, not everybody in general. People seem to think, well, this is different. How? We already know that if you don’t learn from history, you’re going to repeat it.

Bob:

Exactly. So you need to learn from and Shawn, I have a saying right now with the way the real estate market is just so high up. And it’s gone up so much in the markets. And you’ve heard me say this around here. You’ll hear people saying, well, man, this kind of thing has to take a breather. I’ll say, listen, you’re going to need to understand something. So here’s my quote. “Markets can stay irrational a lot longer than a rational person can stay rational.” It will go way beyond what a rational person would ever think it would go beyond. So even if you do you think, gosh, we got to take a breather. I mean, real estate in some areas of the country are 80%. Other areas up over 30. I mean, as an average, it’s up over 20. It’s got to take a breather, but not necessarily. It may go like this for another year or two. Who knows. And a lot of it has so much to do with interest rates, and I was looking at these mathematical formulas and in looking at a $400,000 home today, if you finance it at 3%, if interest rates just go up 2% and you were to have to finance it at 5% to equal that same payment, you’d get at 3% for 400,000, you’ve got to lower the price to $314,000. You’d have to lower that price from $400,000 all the way down to the $314,000 if interest rates went up just by 2% to give the same payment and people don’t buy homes today with cash, they buy them based on payment.

Shawn:

Especially when you’re talking about individual family homes, most people are not in a situation where they can buy cash. So you’re absolutely right that it’ll affect the buying power of the market if interest rates change even just that much.

Bob:

So what we’re going to do today is we’re going to look at five examples of historical booms and busts. And we’re going to start way back, though. I mean, we’re going to go back thousands of years. I’m going to look at the Roman empire and I want to see what can we learn from the rise and fall of the Roman empire? We all know about that from our history books. And what were the causes? So what caused Rome to rise and then what caused it to fall? This is going to be a little bit different than our present day examples though, but still, a lot of the same things fall along the same lines.

Shawn:

Bob said we’ll start with the rise and fall of Rome. There were technological advances that helped the rise of Rome. Number one were roads. Roman roads were the most advanced roads in the ancient world at that time. It enabled the Roman empire to expand over 1.7 million square miles at the pinnacle of its power to stay connected. They included such modern seeming inventions as mile markers and drainage. Over 50,000 miles of road were built by 200 BC. And several are still in use today.

Bob:

That’s amazing that they’ve been around that long. So that was a new technology back then. So that would come along with the technological advancement, building roads the proper way. And they were all weather roads, as I was doing this research, that that was a big deal yeah that they weren’t getting bogged down in just mud.

Shawn:

Yeah. And it drastically increased the travel capacity of those roads, because if you have a dirt road, I mean, anyone out there who, even in our modern cars, if you’re driving on a really nicely paved, like brand new stretch of road, and you turn off onto that dirt road to go see your friend in the country, has anyone else noticed a difference that it’s a little bit rougher and you got to go a little bit slower on that dirt road.

Bob:

So, the other huge technological advancement that helped with the rise of Rome.

Shawn:

It was the concrete. So Roman cement and concrete are a big part of the reason ancient buildings like Colosseum and the Roman forum are still standing strong today.

Bob:

We tried to go see that last year and we had all these reservations to go across, and then covid came along and Rachael was not happy.

Shawn:

No, no, she was not. But Rachael, if you’re listening to the episode right now, it’s been there for a while and it’ll still be there.

Bob:

Exactly.

Shawn:

So another technological advancement was in water. So Roman aqueducts first developed in 312 BC enabled the rise of cities by transporting water to urban areas, improving public health and sanitation. Some Roman aqueducts transported water as much as 60 miles from their original source.

Bob:

This enabled that city to really grow to grow in size. And when you pull that many people together, you have a lot of commerce going on.

Shawn:

Yeah. An interesting parallel with that is Los Angeles. There’s not enough water for that city. And they actually have water coming from far away, hundreds of miles away, but the Romans did it first, as far as doing it well. So another one is in architecture, Roman arches or segmented arches improved upon earlier arches to build stronger bridges and buildings, evenly distributing the weight throughout the structure, which you should definitely Google that. There’s some really cool videos on the arches and how that changed. And of course, the last one, strong military. Rome’s military conquest led directly to its cultural growth as a society, as the Romans benefited greatly from contact with such advanced cultures as the Greeks.

Bob:

There was so much of that that played into the rise of Rome. Then along came the fall. We’ve all heard about the fall of Rome. And when I was doing my research, these are some of the reasons I found that happened and caused that fall. And as you’re listening to this, think about where we are today in America. Do you see some of this? Number one was big government and overspending. They got too big for their britches. Bottom line is they just got too big and because of that, oppressive taxation of the wealthy. Sound a little bit like today?

Shawn:

So far two for two, I think.

Bob:

But they got so oppressive it caused people to leave the country. Overexpansion. Just getting too big. Government corruption. Hmm.

Shawn:

Okay. We don’t have any of that.

Bob:

Yeah. Not at all. Political instability. Look at the fragmentation we have in our country today, the disregard for human life, just the coliseums and…

Shawn:

Gladiators. You had the slave trade.

Bob:

Yeah, that’s a lot. And then what played into that was immorality, sexual immorality. And this is interesting. When not when I found this one, I said, gosh, that sounds a lot like today, a mass migration of people into the country from other countries, into the empire from other countries. And they had a weakened military. The military started becoming weak. So I don’t know, Shawn, does this sound at all a little bit like today. Now we’re not saying the fall of America is coming next year. No, not at all.

Shawn:

There’s just a lot of similarities.

Bob:

I see a lot of similarities in there. And so, that’s really looking back a long way back in history, but it was the technology that helped them to grow so much because that technology was not there yet. This has come all the way forward and let’s look now at just the last hundred.

Shawn:

One thing though, Bob, just one point I wanted to make on that. It’s really interesting, though, with all of the technological advancements and advantages that Rome that contributed to its original rise. And yet the fall of it, when you look at pretty much everything you mentioned, it’s really all from within, at its core. It wasn’t that, oh, this just one country rose up and was able to completely demolish Rome or there was some catastrophe. It was mostly a fall from within.

Bob:

Yeah, it was. And I think it’s natural though. We go back to there’s a time for everything. The time to grow up and then a time to rebuild. So that’s gonna bring us to the last hundred years and we’re going to look at some examples that have been very recent, but we’re going to look at a hundred years ago exactly.

Shawn:

So the roaring twenties and yeah, it is very interesting that we’re talking about this effectively exactly 100 years later. So in the roaring twenties, we had technological progress. Again, technology. We had the assembly line, mass production of goods, the start of automation. We had the electrification of America going from candle light only and gas to most homes and businesses in America having access to electricity

Bob:

And industry.

Shawn:

The rise of the automobile, making us much more mobile and efficient, kind of like the work from home idea. The size and growth of cities in the job force when everyone’s commuting by walking or by carriage, there’s only so far and so much growth that you can have, and you introduce the automobile, that changes things.

Bob:

Yeah. And that really caused the rise in the twenties. And when I was doing my research. People could live 30 miles outside the city and go to work.

Shawn:

Which would have been unrealistic.

Bob:

It wouldn’t have been possible before then.

Shawn:

New mass marketing techniques that got people to buy more products and services, basically the rise of modern consumerism. Cheap credit by the banking system with unwise and fearless lending.

Bob:

Yeah. They went crazy. Here’s the money. Go do it. Hmm. Yeah. Sound at all like today?

Shawn:

No, it doesn’t sound like today at all. So another one, a major stock market boom full of speculation. And last one, a major rise in gambling and corruption.

Bob:

Yeah. So these were so many things that played into it in the roaring 20’s, and as we know, it was thought of as so great that it was called that, the roaring twenties, and really no one ever thought this would come to an end, but that reckless spending and borrowing and speculation, eventually that bubble did burst. And it nearly did it overnight. And then we know what came after that. It was the roaring twenties, and then it was the Great Depression, the 1930’s. So again, if this sounds like today, maybe it does, but remember, like I said in the beginning, this thing can go a whole lot longer before this bubble breaks. I mean, it could go another 50 years.. But we’re not going to go another 50 years before we have some pull back into the markets and stuff. But I just don’t want people thinking, oh no, Bob’s preaching doom’s day. No, I’m not, but I’m showing you history. And just like the 1920s where they had all this technological progress. We’ve had that same thing. We’ve had enormous technological progress in the last 10 years. And remember you were pointing out that new mass marketing techniques and back then it was magazines and newspapers and billboards coming out. We’ve had that same thing happen in the last 10 and 15 years. We’ve had major mass marketing thrown at us through the form of social media, the internet, entertainment, Netflix, TV. I mean, you notice now you’ll watch a movie and they’re advertising a product. Yeah. They pay to have that done.

Shawn:

The advertising has become part of the medium itself, the movie you’re watching or the TV show you’re watching and many times it just seems so natural. You don’t even think about it, but like people would see a movie or something. And like, oh, there was a Coca-Cola sitting on the desk or there was an apple or a Dell computer or certain kind of car. They’re not even advertising it, but it’s like, you have that psychology of people seeing.

Bob:

They actually are advertising it.

Shawn:

But it’s not overt is what I mean.

Bob:

Exactly. And in the 1920s, you were talking about cheap credit. Well, today we’ve got artificially low interest rates to stimulate the economy, and they’re artificially low. They cannot continue. It’s like candy, you can’t eat everything. Your kids can’t cannot continually eat candy. You gotta have some substance. And in huge amounts of consumers that have been given money by our government to buy goods and services, and even stocks, you hear these stimulus checks are going into buying stocks, pushing that market up. So yeah. So, that’s the 1920s. Now let’s get to some more recent examples. We went a thousand years ago.

Bob:

And then we’re going to bring it right up to the last 10 years or so.

Shawn:

And for this one, we’re going to go to another country. So we had Rome and the United States. So now we’re going to jump over to Japan in the 1980s. So Japan had a huge industrial expansion. In the eighties, Japanese automobiles virtually took over the world.

Bob:

I remember we wanted a Honda accord really bad. And so, you had to wait, you would go order it and you would have to wait like 12 weeks. And we did, we wanted one. So we went and ordered and we waited and waited and it finally came in. And I mean, it was just a huge rise in the eighties. And that was a really good thing for Japan. I mean, it was pushing them there.

Shawn:

They were exporting goods. They weren’t just importing. They weren’t just consuming. So another one was easy credit by the banking system. Just like in the 1920s in America, which made for enormous expansion. A large financial speculation by businesses and investors. I feel like every time we start going through these, there’s so many, they sound like, wait, did I jump to the wrong spot and talking about Rome now? We’re talking about America in the twenties.

Bob:

No, it’s the same thing over and over.

Shawn:

Another one, a roaring Japanese stock market went to all time highs, and the final one, a real estate boom of such magnitude in housing that Japanese families were taking out multi-generational mortgage loans to pay for housing.

Bob:

Now, is that insane? That’s crazy. See, that’s why this real estate might keep going. I mean, we could get to the point that homes are so high, we do like Japan and we start doing multi-generational mortgage loans.

Shawn:

Which just sounds insane.

Bob:

It is. But then what happened? It all busted again. Does this sound anything like what could be happening today, except we’ve not burst yet. And I don’t want us to, believe me. I do not want that to happen. But things like easy credit, large amounts of speculation, and a roaring stock market at all time highs, it’s just, you see this stuff over and over.

Shawn:

Well, we’ve essentially been in a quantitative easing phase for so long and continuing to lower interest rates, continuing to just make things easier. But really, what we need is we need some quantitative tightening. We need to take control before it goes to 20 plus percent inflation.

Bob:

Yeah. Yep. Exactly. And we heard a couple of weeks ago, inflation is only 2%. I’m like, what world are you living in? But then this morning it just came out that it’s actually 8% or 9%. Hmm. Wow.

Shawn:

If I’m doing my math, right, Bob, maybe you can double check it for me. But 8% is more than 2%, right?

Bob:

About 400% more. And all of us know, you just go fill up your gas tank at the car or you go to the grocery store. I’ve been here. A lot of our clients are retired, and they’re on a fixed income. And they’re just like, I cannot believe how much food is going up.

Shawn:

And gas too. Like, I don’t know about – depending on where our listeners are from, but at least here in central Texas, we’ve had pretty much even premium. Like the 93 level octane for the fuel was at most maybe $3 or under, and it’s been that way for a while. And now you’re seeing the only gas you can get that’s under $3 a gallon and still pretty close to it is the cheapo stuff, the 89.

Bob:

Yeah. I know. But Rachael’s car is a German car. We gotta put the good stuff on it.

Shawn:

It’s just something for even the most casual person you kind of see, I remember that was cheaper not that long ago.

Bob:

Yep. So now we’re getting to basically the last 20 years and let’s look at the late 1990s and that was called the internet bubble. And this was where we had the growth of the internet and it just created this huge buzz among investors that poured billions of dollars into internet startup. Think of startup.

Shawn:

Yeah. Hmm. And by the way, not all of them made it. I mean, there were some, I don’t know if anyone’s ever heard of Google, haha, but they’re still around.

Bob:

But any buzz like that today? Could it be so-and-so called Bitcoin?

Shawn:

So, what are we up to 4,000 somewhere? However many different cryptocurrencies?

Bob:

It’s crazy. But in back then these companies were able to raise enough money to go public, and they had no business plan. Really didn’t have much of a product or a track record of any profit. There was enormous speculation that every new tech company, okay. We say every new Bitcoin today – that every tech company would eventually make money, regardless of experience, net earnings, or real profits. And when all this capital dried up, many of these companies just completely folded and burst.

Shawn:

Yeah, yeah. You’re absolutely right. I think that’s a great comparison to compare it to the cryptocurrencies but Bitcoin, of course, is the most popular. I believe it was the first or at least it was the first one to really become a household name. But it just seems like there’s a new cryptocurrency every week.

Bob:

We were just talking about it yesterday.

Shawn:

Yeah. Yeah. And guess what, just based on the laws of averages and statistics, I have a feeling most of them won’t be around 10 years from now.

Bob:

The cryptocurrency, I think, is here to stay.

Shawn:

Oh, absolutely. Yeah, but not all of them are necessarily going to be.

Bob:

Just like the internet was here to stay. So, now we go to our most recent example of a bubble and a burst. And by the way, that burst from 1999, 2000, that burst took us six or seven years to recover. Just to get back to where we were, and then we had this happen, the 2008….

Shawn:

Real estate and stock market bubble. Oh man, this is this is hitting a little closer to home, Bob. This wasn’t that long ago.

Bob:

Did you come over in 2008?

Shawn:

My first year with you was 2008. So that was, for those who can’t see me, I’m using air quotes, fun time to get started in investment management. It was a little crazy.

Bob:

And just like today, what caused that?

Shawn:

Well, loose credit for anyone wanting to buy a home, regardless of having an income or job, and the idea that it is everyone’s right to be able to own a home, and as much as I would love for everyone to own a home, there’s responsibility that comes with that. You need to be able to actually afford the home.

Bob:

Oh, that was what was so unique about that. You do have to have a job and income. It’s just that the credit, again, we’re back to the same thing because it’s so cheap. Yeah. And we just had unprecedented growth in the subprime mortgage market.

Shawn:

Yup. And then we also had the US government sponsored mortgage lenders, like Fannie Mae and Freddie Mac to make home loans accessible to borrow with no or low credit scores, resulting in higher risk of defaulting on these loans. We also had financial firms selling subprime loans to large commercial investors in pools of mortgages known as mortgage backed securities, or MBS, on wall street.

Bob:

That’s what pushed the markets up so much. Yep.

Shawn:

And then the final one was banks lending loosely to developers and home builders to develop massive subdivisions and build homes for thousands of borrowers that can never afford to make even one to two mortgage payments. Which the tech boom, the internet boom, kind of the same thing. It’s like, well, we’re going to invest in this cause it’ll come like, well, what’s the business plan? Who is actually going to buy this? Oh no, we’ll figure that out later.

Bob:

And then we were all caught by surprise with what happened.

Shawn:

And then for those who aren’t aware. 2008 we had a fairly significant crash in the markets, both housing and real estate and stocks.

Bob:

It took five years for the market to rebound back to where it was. Wow. Five years. Now, remember the market was where it was in 2000. It dropped and then it came back to where it was in 2000 and about 2007 to 2008. It was just back to where it was in 2000. Then it dropped again, and didn’t come back to where it was in 2008 and year 2000 until 2013. People don’t realize, because they forget, that if you just invested in the S&P 500 minus dividends, you’d have basically had the same price for 13 years, which is when you think that you’re making 10% on average a year. No, you were not, not during that time. And so now, it takes us to today. We’re at 13 years now past that 2008 bubble. And so many of these bubbles that we were pointing out over the last hundred years, they were based around loose credit and over speculation. Remember those two words – loose credit and over speculation. And COVID, it’s just been such a bad thing, but it’s created a huge pent up demand for almost everything. We’ve never seen people respond like this. And these artificially low interest rates are causing, like I said, in the very beginning of the podcast, an abnormal rise in home prices. In some places as much as 80% over the last year, but the norm is 20% plus, and that’s not normal. Real estate will normally just stay with inflation. So it’s way, way beyond inflation.

Shawn:

And then the other one, of course, is the stock markets speculation. We’re at all time highs with thousands, if not millions, of inexperienced buyers, purchasing companies with no real net earnings. Take, for example, the rise of Robin Hood as a trading app. And they’re not the only one. We’re not picking on Robin Hood, but when all of a sudden your technology changes and you have people who are working from home, people who are maybe unemployed, but they’re receiving payments, and they’re bored. And they’re like, well, I’ll play this. I some play money, a thousand dollars here, a thousand dollars there, and I’ll just buy whatever the app told me I might need to buy.

Bob:

And they’re speculating on companies that have no real net earnings and they’ve never seen a downturn. That’s the scary part of it.

Shawn:

Another one that’s consumerism, which again, I think we’ve talked about that multiple times. Consumerism were at all time highs because for many it’s a temporary fix to raise their self-esteem after being just so down and shut in from COVID, and we’ve also seen a rise in people reaching out for counseling, people suffering from depression, like medication, and I mean, it makes sense. People have been hurting, but for many they’re turning to consumerism.

Bob:

Just seems like there’s all this COVID and all this government giving unemployment. And I mean, I was just with a business owner yesterday. He says, I can’t hire people because I can’t compete. I heard not just from him yesterday, but I heard the same thing with a big lumber company that is down the road from us that has multiple locations across Texas saying that kind of the breakeven point is around $18 an hour to compete against what unemployment’s been giving. So this has really created a buying frenzy for almost everything from new cars to buying stocks online, to new homes, to new second homes with all the artificially low interest rates. Online shopping has become that new high because the apps make it so easy to just spend it, spend it, spend it, and Shawn, it’s just getting crazy. I don’t know how long this can continue. Like I said, a whole lot longer than a rational person can stay rational.

Shawn:

Well, Bob, at this point we’ve covered a lot. So I guess there’s really only one thing for me to ask you. So Bob, are we in a stock market and housing bubble, in your opinion, that is about to burst?

Bob:

Well, I’m not going to give you that true opinion over a podcast. Okay. Cause there’s many opinions about being at the top of markets as well as at the bottom, and honestly, Shawn, no one really knows. Really, no one knows. I know that the programs like CNBC, they’ve got their bear market guys and they got their bull market guys. And when it gets real bad for a few days, they go grab the bear market guys and pull them on because they’re media.

Shawn:

You’re just saying the entertainment companies that pretend to be news don’t necessarily know for sure what will happen?

Bob:

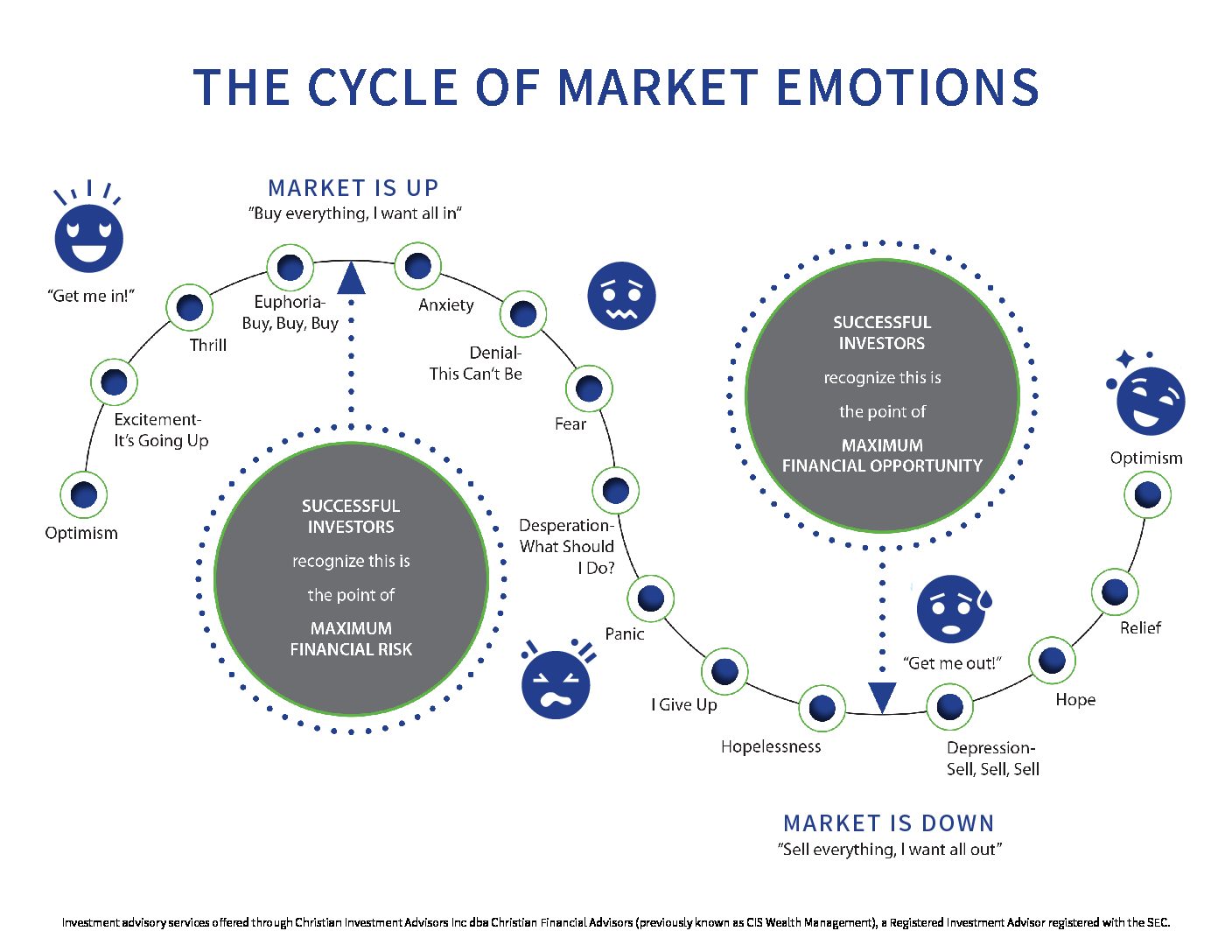

And no one does knows that. I just know this. There’s always, and I want y’all to really hear me on this, there’s always a common mentality level during every bubble that I’ve ever seen that is different this time, this thing is not going to break. It’s going to keep going. And from my years of experience, people are going to continue to buy and buy and buy into a bubble until it finally bursts. So it has to take that. This thing could go a whole lot longer. I have a great chart I’ve been referring to for many years, though. And you know I’m always talking about that. It’s called the emotions and cycles chart. We’re going to put this on our website for Christian financial podcast so you can see this. I’ll have Jenna put this up. You’ve heard me refer to it. If you’ve listened to a lot of my podcasts, you’ve heard me refer to this many times over and over, and I can tell you, if you look at that chart, we were at the buy, buy, buy right now. It’s a frenzy. It’s like, no matter what the price is. And I’m really seeing that in real estate, but it’s an interesting chart.

Shawn:

That’s very interesting. And as Bob said, we’re definitely going to make sure that we put this, it’ll be on the episode webpage. So, the page on our website, just for this episode. So you’ll be able to listen, read the transcript, as well as you can access this chart. And I would definitely encourage you to look at it, which kind of reminds me, Bob, for people in general, they’ll continue to buy all the way until actually a bubble bursts, but what I always love, and you’ve said this before, as a very contrarian investor, you buy when no one else wants to touch it, you sell and move more to cash when everybody wants it. And probably the most famously known person for that is Warren Buffet. It’s almost like a, here’s your insight, maybe an insider tip for lack of a better term. But when you hear Warren Buffett is buying such and such industry, maybe we’re starting to turn around. Like there’s no guarantee, but like maybe he’s seeing something

Bob:

What’s so interesting to me is always on these programs, and you’ve heard me say this around here. Do you ever notice that when we have a bust, all of a sudden they go find the people that have money, and they’re great investors, like the Warren Buffetts, he always has money to put in. And I’m like, okay, so when did he get all this money? Could he have been selling silently when everybody’s buying? So the good investors like that who are the trillion investors, they’re selling at the very top. They’re not voicing it. They’re not telling everybody about it. And then when the bottoms come along or when these markets really drop, they have the money to do it. Shawn, as we talk about these market bubbles and bursts and we look at history though, I want to tell you the true answer to all this. And we’re going to go into this next week is what the Bible says and how to handle these booms and bursts. I call them bulls and bears as well. And we started today’s podcast with that scripture from Ecclesiastes. There’s a time for everything. And I believe we should enjoy these good times and also be ready and wise for the difficult ones. And from experience, I’ve seen in either the good or bad times. It’s hard for many people to realize that that neither the good or the bad times are going to last forever. And there’s many biblical guidelines for all this. So on our next podcast, it’s going to be called biblical guidelines for booms and busts. And in the meantime, I would invite everybody to stay alert and cautious as a fox. We live out in the country. We have these foxes come up and you’ve got to see them. They’re looking around. They’re staying cautious, and a fox in the wilderness doesn’t want to get taken out. He’s looking for something else to take out. So, I just really invite all of you, until we do our next podcast, get into God’s word. It says so much about that and read that scripture about a time for everything.

Shawn:

Or maybe a different way to look at it. If you’re going to be anything, be cautiously optimistic. It doesn’t mean you have to be all doom and gloom, but don’t look at this as, “Oh, this time it’s going to be different. This time it’s going to keep going,” because it probably won’t, if we’ve learned anything from history. So as always, if you have any questions, feel free to call us at (830) 609-6986, or you can visit us on the web at christianfinancialadvisors.com and Christianfinancialpodcast.com.

Bob:

Well, that was fun today, Shawn. Back in the saddle again. So the podcast will be coming out. I’ve already got my next 10 or 11 lined up, ready to come out.

Shawn:

All right, we’ll see you guys next time on podcast 101.

[CONCLUSION]

That’s all for now.

We invite you to listen to all of our past episodes covering many financial topics from a Christian Perspective. To make sure you don’t miss any of Bob’s upcomin

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast