Notes from the CIO

The Logic of Asset Management

Cash holdings may provide comfort, but inflation diminishes the value of uninvested cash over time. Outside of purchase delays and product substitutes, there is little more consumers can do to directly address inflation. Investors, on the other hand, have a range of options to address that potential drag. The greater the expected return of a portfolio, the potential greater success one may find in achieving financial goals, which may specifically include seeking to beat inflation. The constant caveat applies: the more return we seek the greater the risk we might not achieve that expected return:

- Short-term Treasury securities may offer a reasonable alternative to plain old cash. But generally relatively low expected returns may mean they at times do not keep up with inflation

- Stocks historically have provided among the strongest total returns across all asset classes, normally offering a substantial cushion against inflation. But stocks are volatile, and may see losses even over long periods

- With bond yields now at multi-decade highs, investors need not see relative safety as a zero-gain alternative to risky stocks. Still, with time, stocks may provide relative returns commensurate to their incremental risk

Listen to this month's Notes from the CIO podcast:

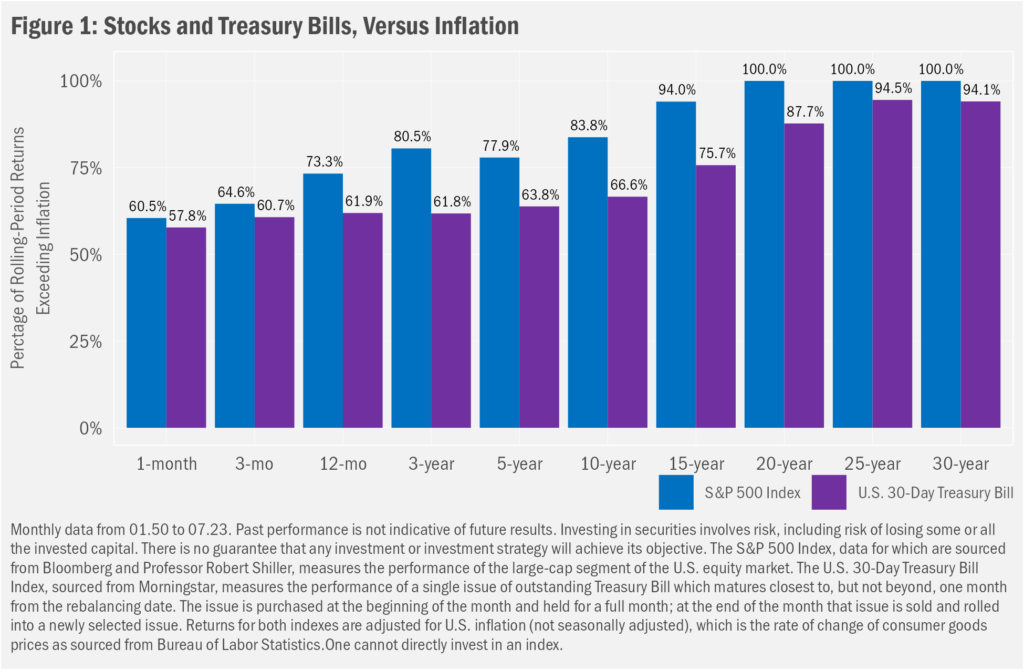

Inflation: Risk of Doing Nothing

Fair to suggest that a minimal expectation for any investment strategy is to maintain purchasing power over time, implying returns in excess of inflation (a positive “real” return). While that goal might seem straightforward enough, achieving it isn’t always so simple. To wit: for the better part of the last 15 years, U.S. inflation, as measured by the year-over-year change in the Consumer Price Index, ran hotter than the yield one could earn buying 1-month U.S. Treasury bills. With short-term bond yields now comfortably above latest U.S. inflation figures (consumer prices roses 3.2% year-over-year in July, versus a 1-month Treasury Bill yield of 5.3% at the end of June), investors can take on very little risk while seeking to ensure their savings maintain purchasing power. That short-term Treasury yields are higher than concurrent inflation marks a return to a relatively more normal situation: As we show in Figure 1, 1-month Treasury returns were above inflation just under three-fifths (57.8%) of the time since 1949.

Investing: Risk of Doing Something

Over longer periods of time, the rate of success improves. While a “most, but not all the time” success rate might fail to inspire confidence, one must remember that T-bill investors are assuming very little risk. There are various ways to address inflation more directly in portfolios, including the purchase of inflation-protected securities and inflation-targeting hedges. But such strategies may come with their own unique set of considerations and risks and may at best only directly offset inflation, rather than provide meaningful “real” gains.

As is generally the case when one seeks higher returns, “beating” inflation likely requires that investors assume greater risk. Equity investments may offer among the more straightforward options available to outgrow inflation. Looking back to Figure 1, while stocks achieve about the same rate of success over 1-month periods providing a return in excess of inflation as 1-month Treasury bills, the success rate for stocks improves more quickly and more substantially over time. In fact, over all historical 20-year periods and longer (using monthly returns), stocks historically have always outpaced inflation.

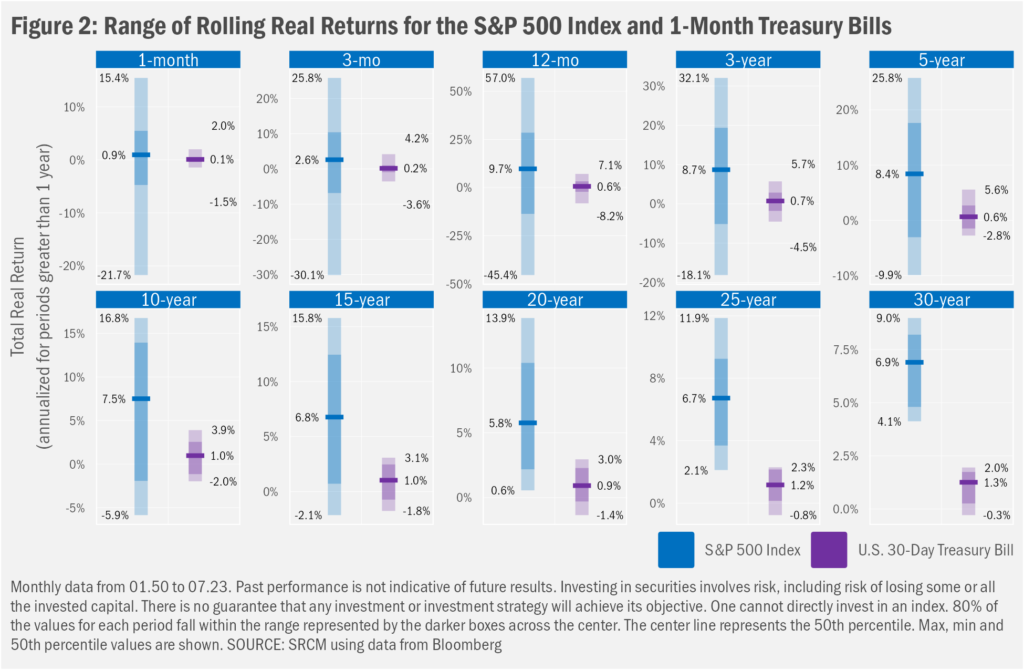

As we noted, however, the increasing historical success at beating inflation can be seen as compensation for having taken on the extra risk of not only not beating inflation, but even substantially underperforming inflation over shorter periods of time. Reflecting this view, Figure 2 shows the range of historical inflation-adjusted outcomes (we calculated the “batting average” in Figure 1 from the same set of data we summarized in Figure 2). For stocks, while the batting average might be better, the range of outcomes is much wider than that for 1-month T-bills. And that wider range has included substantially more negative outcomes than 1-month T-bills over shorter time frames.

Neither short-term Treasuries, nor stocks therefore guarantee a better-than-inflation outcome. Nonetheless, over shorter time frames, though Treasuries may have shown a weaker average chance of beating inflation, they’ve tended to have shown a far greater likelihood to have offered returns that have approximated inflation. Those results may still compare favorably to stocks, which have proved far more likely to disappoint—sometimes intensely so—over shorter time frames.

When’s Been the Mismatch?

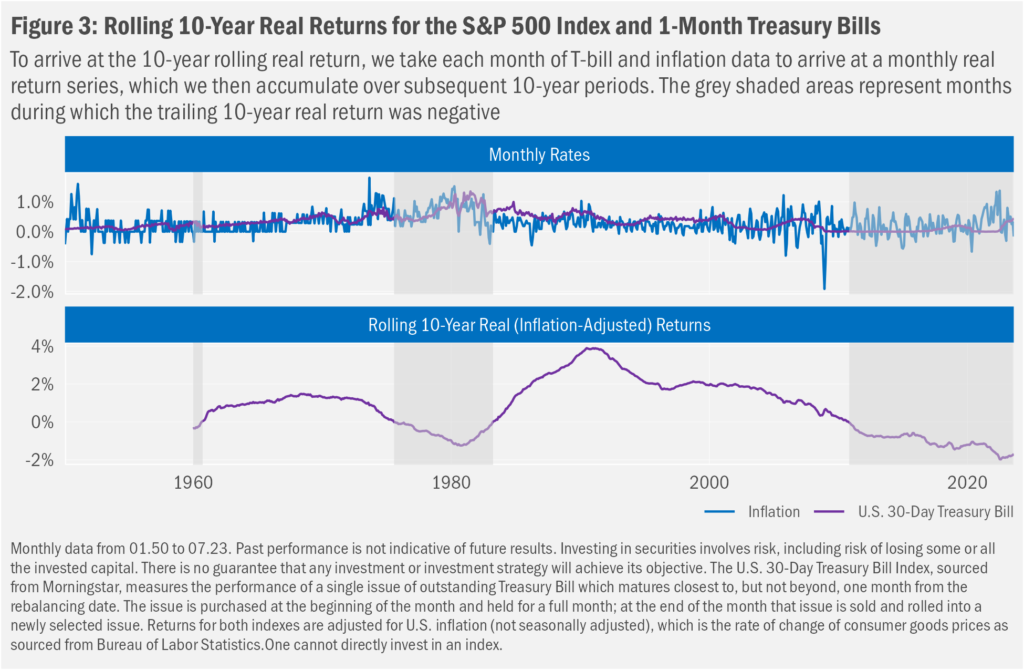

Regarding “when” T-bills have tended to underperform inflation, we have seen two general scenarios over the past century. The first, perhaps more obvious reason relates to occasions when inflation surprised to the upside. As we show in Figure 3, the late 1970s saw 1-month rates of inflation often exceed the concurrent levels of 1-month Treasury bills. That mismatch led to a long period of trailing 10-year returns that underperformed inflation. Only after the much higher interest rates of the very late 1970s and early 1980s were in effect did short-term Treasuries begin to provide inflation-beating trailing returns.

A surge in inflation over the last two years led to a similar drop into negative territory for real returns for 1-month T-bills. But that mismatch came on the heels of nearly two decades during which time short-term interest rates were generally below monthly rates of inflation. As the Federal Reserve held the federal funds rate (its short-term target for overnight inter-bank lending) near 0% on account of desires to stimulate macroeconomic activity and to avoid a potential deflationary environment, 1-month T-bills followed suit. But inflation generally hovered near the Fed’s long-term target of 2% nonetheless, the result being a repression of real returns for short-term Treasuries. The longer-term Fed-forced mismatch, followed by the recent spike in inflation proved a double whammy for trailing real returns.

A comparable inflation surge on the heels of World War II dragged down relative returns even 10 years later. After inflation subsided, however, relative returns were set up to outperform over the subsequent years. We tend to think we have entered a similar environment. With short-term rates in excess of inflation, so long as inflation continues to cool, real returns should remain reasonably positive.

Readers will want to note the “so long as” and “should” qualifiers in that sentiment. Naturally, going-forward relative returns will be entirely dependent on the realized returns of the various asset classes in consideration, versus each other and inflation. Deciding where to position portfolios in light of client comfort with those unknowable factors and the relative volatility across the range of asset classes suitable to individual client investment scenarios remains core to our work as financial advisors and portfolio managers.

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The S&P 500 Index measures the performance of the large-cap segment of the U.S. equity market.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.

Visit Podcast Website

Visit Podcast Website RSS Podcast Feed

RSS Podcast Feed Subscribe

Subscribe

Add to MyCast

Add to MyCast